Microsoft reported better-than-expected first quarter results and delivered Azure revenue growth of 40%.

The software and cloud giant reported first quarter net income of $27.7 billion, or $3.72 a share, on revenue of $77.7 billion, up 18% from a year ago. Non-GAAP earnings for the quarter were $4.13 a share.

Wall Street was looking for Microsoft first quarter earnings of $3.67 a share on revenue of $75.33 billion.

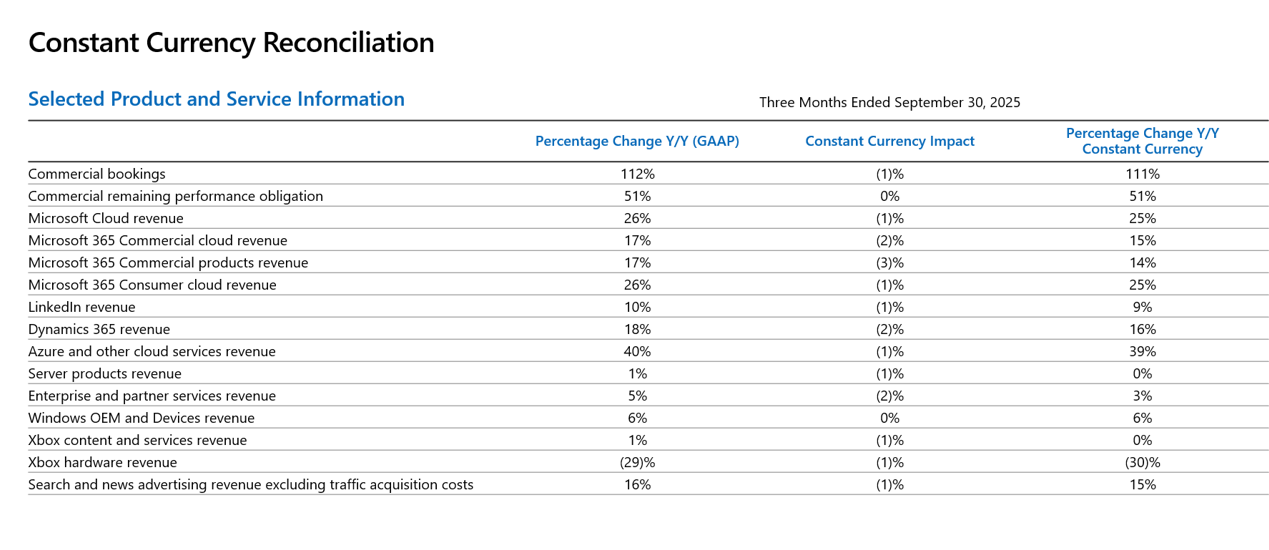

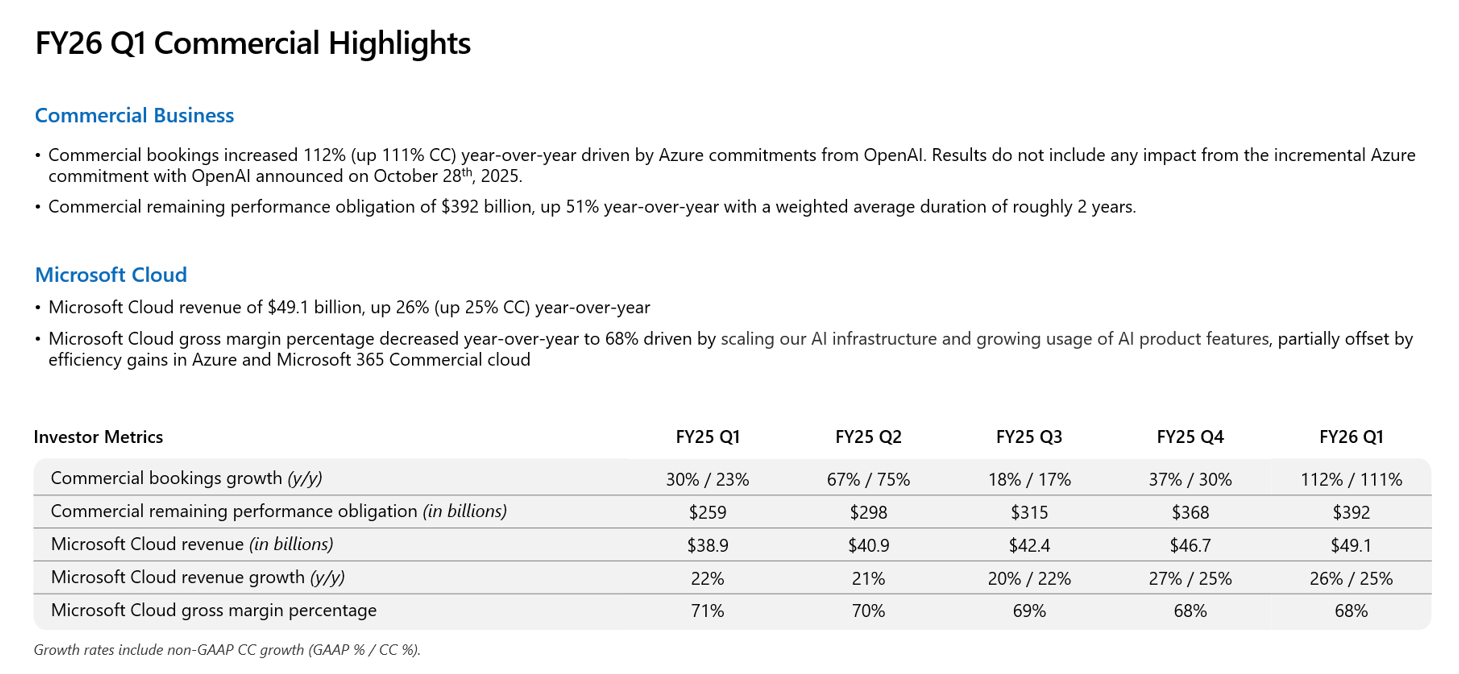

Microsoft Cloud revenue was $49.1 billion, up 26%. The company's Intelligent Cloud unit had revenue of $30.9 billion, up 28% from a year ago. Azure revenue was up 40% from a year ago in the first quarter.

CEO Satya Nadella said the company's AI factory and high end copilots were paying off. "It’s why we continue to increase our investments in AI across both capital and talent to meet the massive opportunity ahead," he said.

Amy Hood, Microsoft CFO, said Microsoft Cloud saw strong customer demand across the board. Hood said that Microsoft will be capacity constrained at least through the fiscal year. She said Microsoft will deliver second quarter revenue of $79.5 billion to $80.6 billion.

Nadella said on the earnings call that the new OpenAI agreement creates more certainty in terms of AGI as well as IP rights. He played down how fast AGI would be here. "AGI will not be achieved any time soon," he said.

He said Microsoft will create value by building systems of AI agents and stringing them together.

By the numbers:

- Capital expenses including assets under finance leases were $34.9 billion, up 74% from a year ago. Half of that sum went to GPUs and CPUs for Azure.

- Productivity and Business Process revenue was $33 billion, up 17% in the first quarter.

- Microsoft Commercial Cloud revenue was up 17% and consumer cloud sales were up 26%.

- Dynamics 365 revenue was up 18%.

- Windows OEM and devices revenue was up 6%.