The view from the C-suite is increasingly gloomy as executives navigate policy, inflation and the economy that's a reality show with two-week story arcs. It's hard to plan when your conditions change every other day.

Yet, technology companies--including a few that barely have revenue--live in a world full of unicorns and rainbows.

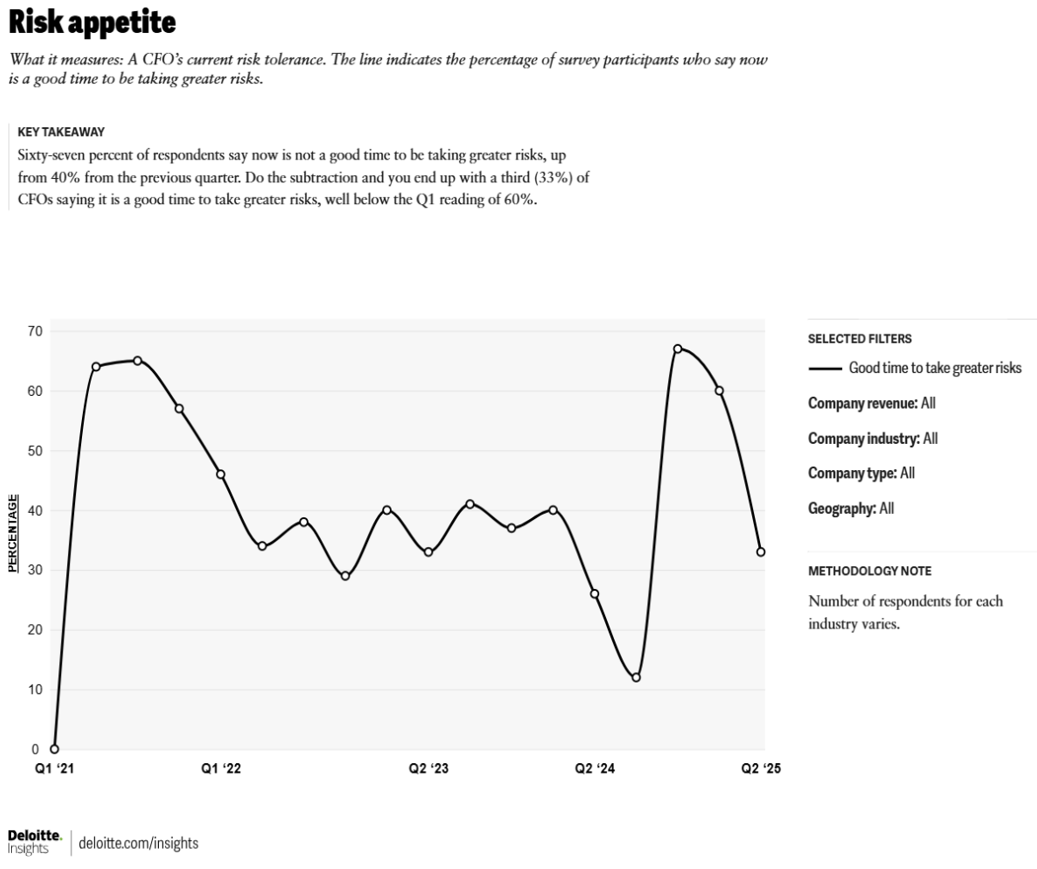

Deloitte's CFO Signals survey found that one in three financial chiefs thought it was a good time to take risks. That reading was the lowest since the third quarter of 2024 and well below the 60% of CFOs in the first quarter who said it was a good time to take risks.

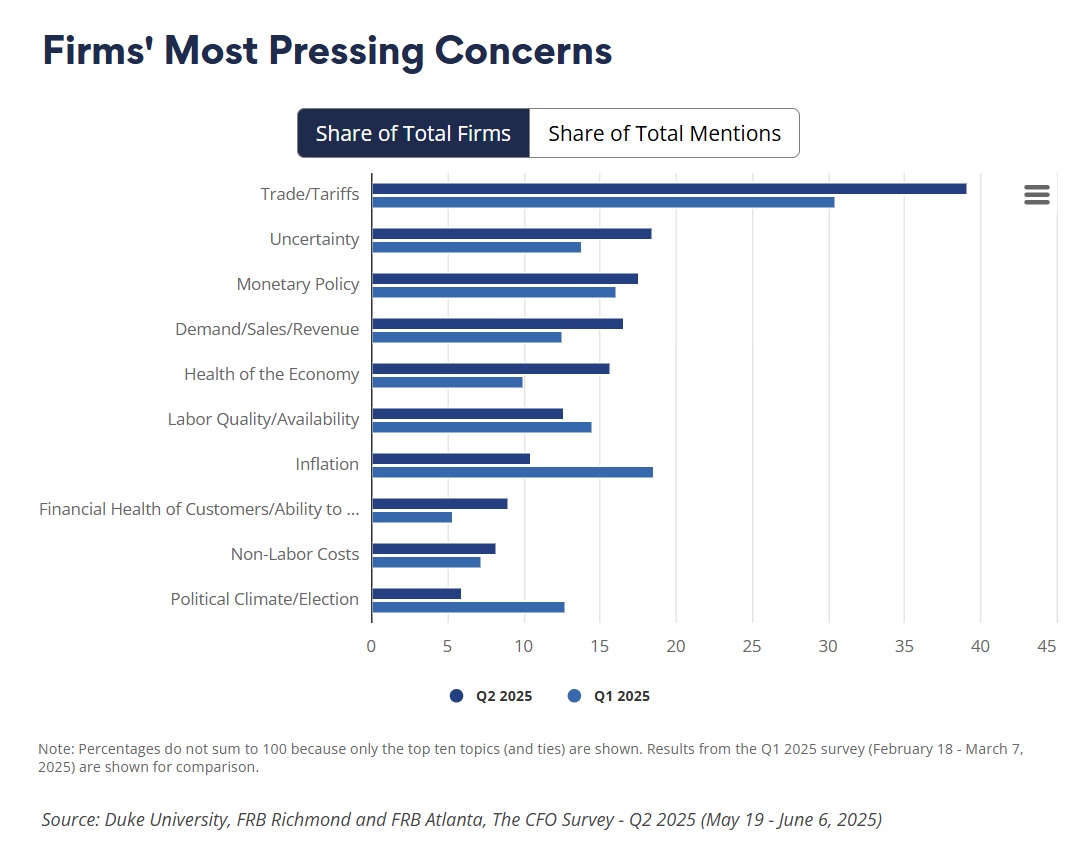

The Deloitte CFO survey follows data from Duke University’s Fuqua School of Business and the Federal Reserve Banks of Richmond and Atlanta. The Duke CFO Survey, which closed June 6, found 40% of respondents said tariffs and trade policy were a pressing concern in the second quarter. That percentage was on par with the second quarter of 2020 when there was a pandemic, supply chain disruptions and inflation.

Is the sky falling? Not if you live in the land of AI, quantum, enterprise technology and Wall Street traders.

Yes, we know the line in enterprise technology is that investing in AI and new proofs of concept will boost productivity and save the day. These technology projects and efficiency gains--courtesy of AI agents--will offset inflation, tariffs and whatever else is thrown at companies.

However, the disconnect between CFOs and technology companies is jarring. There is a possibility that CFOs are worrywarts, but it's more likely that technology companies are overconfident in what is an emerging bubble in various categories.

There's also some evidence that technology firms are using Wall Street euphoria to better position themselves for turbulence. See: AI's boom and the questions few ask

Here are a few mileposts to consider.

Emerging tech companies are using stock runs to reposition. Who will be the bag holder?

Quantum computing companies are busy fortifying balance sheets as their stocks continue to surge. The goal for these quantum companies is obvious: Raise cash because quantum computing is going to be a long game.

IonQ is playing the stock run beautifully. The company priced a $1 billion equity offering of more than 14 million shares at $55.49 and pre-funded warrants. The 7-year warrants convert at $99.88 a share.

IonQ acquires Oxford Ionics for $1.07 billion, gets quantum-on-a-chip technology

All that mumbo jumbo aside, the biggest takeaway is that IonQ will have $1.68 billion in cash to commercialize its quantum offerings. IonQ is also a fan of acquisitions.

Meanwhile, D-Wave raised $400 million with an at-the-market equity offering. Quantum Computing Inc. closed a private placement of stock to raise $200 million. D-Wave and Quantum Computing now have cash and cash equivalents of $815 million and $350 million, respectively.

More stock and debt fun with CoreWeave

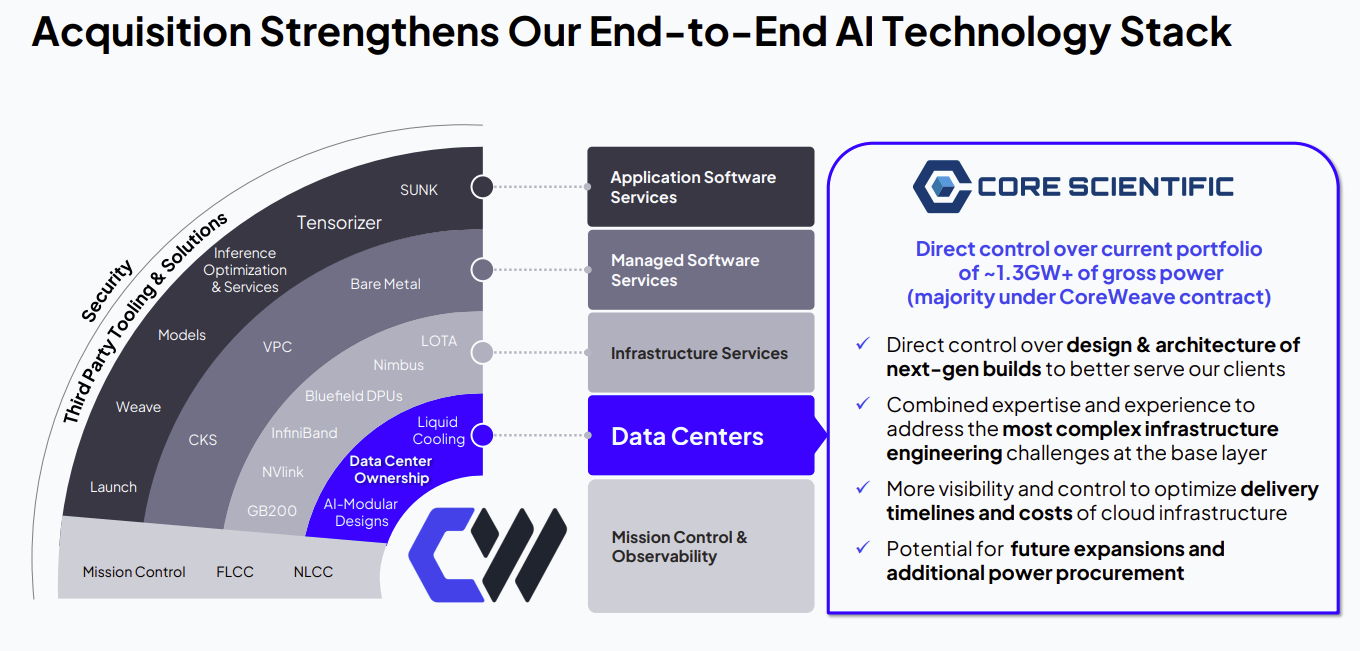

CoreWeave bought Core Scientific for $9 billion in stock. Is CoreWeave getting into bitcoin mining? Nope. CoreWeave depended on Core Scientific for data center capacity. By buying Core Scientific, CoreWeave gets to save on leases and control more of its stack.

Shares of CoreWeave have surged roughly 300% since going public three months ago. Michael Intrator, CEO of CoreWeave, was asked repeatedly by analysts why it had to buy Core Scientific when the existing partnership worked well.

"Owning Core Scientific's high performance data center infrastructure enables us to significantly enhance operating efficiencies and de-risk our future expansion. By controlling the foundational layer of our AI cloud platform, we will enhance the scale, performance and expertise we provide and our customers need to unleash the full potential of artificial intelligence," he said.

There's also a cost of capital issue. Intrator said consolidating Core Scientific allows it to more efficiently finance data centers and lower the cost of capital. "We think it is a pretty material step function in the efficiency of our balance sheet," said Intrator.

CoreWeave as of March 31 had $8.8 billion in debt with cash and equivalents of $1.3 billion.

AI talent free agency goes crazy

Is there anyone that Meta CEO Mark Zuckerberg won't hire? He's building his superintelligence dream team and I'd love to be a fly on the wall to see the ego class in those early meetings.

Super teams and supergroups sometimes work, but more often than not they fail. Management, teamwork and a common cause matter. Zuck has hired a bunch of mercenaries. And who can blame these AI folks for taking up to a reported $100 million in cash and stock? Bloomberg reported that Meta hired Ruoming Pang, who ran Apple's AI models team, with a deal valued at more than $200 million over several years.

OpenAI CEO Sam Altman has countered with its own hiring of AI engineers. Altman had said AI missionaries will top mercenaries on chasing superintelligence.

Anyone who's a big sports fan knows this drill. Pro teams pay out massive contracts to players and many turn out to be busts. This AI talent frenzy will be no different.

Everyday hardware becomes more valuable on AI dreams

And Zuckerberg isn't done. He's also reportedly buying a 5% stake in EssilorLuxottica, which owns Ray-Ban, Oakley and other brands to control distribution of glasses. Meta and EssilorLuxottica have a successful partnership for smart glasses.

Google has also partnered with Warby Parker. Meta obviously wanted to cut rivals off from partnering with EssilorLuxottica.

Watch what tech executives do, not say

Insider sales at tech companies have been picking up as executives cash out. Nvidia executives are selling and the transaction data for the last 60 days is littered with technology companies.

Barchart.com's tracking data for insider trading shows a lot of red. In fact, a spot check of insider buys appears to revolve around non-tech companies.

You can play around with the data, but there are multiple big insider sales at Atlassian, Nvidia, Dell, Rubrik and Oracle to name a few.

Vendors are busy counting demand well into the future

Oracle CEO Safra Catz told employees the company is off to a strong start in fiscal 2026 and the company signed multiple large cloud deals "including one that is expected to contribute more than $30 billion in annual revenue starting in FY28." OpenAI is reportedly Oracle's big contract.

Now that ability to predict future demand is awesome. Way to go Oracle! A cynic would note that a lot can change in two years. OpenAI is a juggernaut today, but who knows how it is positioned two years from now or whether it’ll be able to pay Oracle.

And while we're talking about future AI demand, there's also an agentic AI fatigue emerging among CxOs. Why? Vendors are talking up AI agents that don't quite work yet, promising ROI that's not there yet and raising prices. CxOs are skeptical, pushing back and about 30 seconds from being really pissed off.

Simply put, it's hard to value demand for technology vendors two years from now when CxOs don't have certainty for more than two weeks. Something has to give.

The view from Constellation Research chief distiller Estaban Kolsky

The CFO sentiment is paired with the board sentiment. A recent survey of board members by PwC found that nearly 40% of them are choosing a de-risking path (what I call a wait-and-see approach) for the first time in many years. Indeed, the number has never gone below 50% and is usually in the mid-60% range.

Among the many signals we monitor, board sentiment has been always the most bullish in a down-market (never waste a good crisis is a good mantra for boards to impose risk discipline on executives). When questioned on reasons for their bearish behavior, the number one word that arose is uncertainty. We live in a constant state of chaos, with myriad geo-political hotspots and economic instability. The lack of an explainable vision for the US role in global trade, the dichotomy between economic policies and tax-and-spend initiatives, and the declining consumer-sentiment all bring a thicker air of uncertainty to board discussions.

Leading indicators that had the economy returning to pre-pandemic levels and investment returning to enterprise technology before the year began have all turned negative.

Does this mean there are no opportunities?

Hardly, there has been no better moment for organizations to clean out the technology stacks and make plans for AI-enhanced, cloud-native ecosystems with optimization models implemented on private platforms. The investments in quantum mentioned above are an indicator, as well as investments in AI, enterprise architecture, and data.

Next worry area? Lack of talent – and Meta seems to be equally concerned about that. We will find a way out of that, hopefully without spending billions, soon. It’s going to be a very interesting summer, and a fast-and-furious Q3.