Taiwan Semiconductor reported strong first quarter results, but most of the questions on the earnings recall revolved around tariffs, global expansion and AI infrastructure demand.

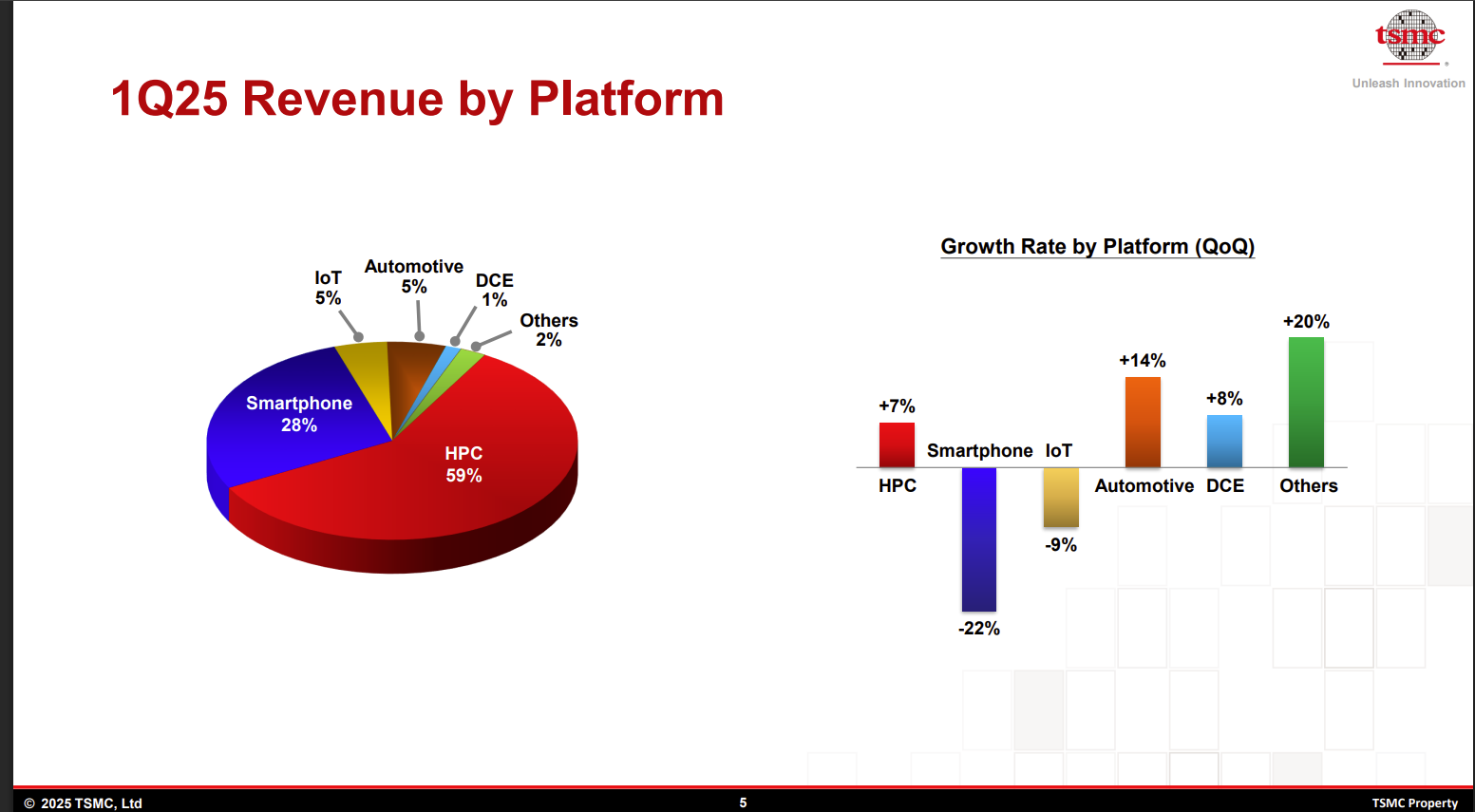

The quarter was carried by high-performance computing. TSMC reported first quarter earnings of $2.12 per ADR on revenue of $25.53 billion, up 35.3% from a year ago, but down 5.1% from the fourth quarter.

TSMC projected second quarter revenue of $28.4 billion to $29.2 billion. The company didn't provide an outlook for the second half of its fiscal year. TSMC results are being closely watched given that it sits in the middle of AI processor manufacturing and faces a lot of economic uncertainty.

- As tech navigates volatility, here's what the big finance CEOs say about the economy

- After volatile first quarter, these 10 questions loom over enterprise technology, CxOs

Here are the takeaways from CEO CC Wei and CFO Wendell Huang:

TSMC sees strong demand from AI infrastructure. In the second quarter, TSMC sees strong growth for its 3nm and 5nm technologies. TSMC expects revenue from AI accelerators to double in 2025 including GPUs, TPUs, ASICs and HPM controllers for AI training and inferencing in data centers.

- AI infrastructure spending is upending enterprise financial modeling

- CoreWeave's IPO: What you need to know

- AI infrastructure becomes one big leveraged bet

Tariffs. "We understand there are uncertainties and risk from the potential impact of tariff policies. However, we have not seen any change in our customers behavior so far, therefore, we continue to expect our full year 2025 revenue to increase by close to mid-20s percent in US dollar terms," said Wei, who added that next few months may give a better picture of any tariff hit.

DeepSeek and other reasoning models are bullish for AI long-term demand. "The impact from AI reasoning models including DeepSeek will drive greater efficiency and lower the barrier to future AI development," said Wei. "this will lead to wider usage and greater adoption of AI models, which all require the use of silicon."

- DeepSeek: What CxOs and enterprises need to know

- DeepSeek's real legacy: Shifting the AI conversation to returns, value, edge

US and global expansion. TSMC's Arizona fab has entered high volume production and the construction of a second fab with 3nm technology is complete. TSMC has two more fabs on decks, an advanced packaging facility and R&D center planned.

Wei added that TSMC is building out facilities in Japan and Germany. "Geographic manufacturing flexibility is an important part of our value proposition to the customers," said CFO Wendell Huang. "We are already discussing this with our major customers, and the progress is so far so good."

Wei said TSMC's 4-year growth forecast for AI includes geopolitical risks but is mindful of potential impacts and end-market demand.

Sorry Intel. TSMC and Intel were reportedly in talks for a joint venture for chip manufacturing, but Wei shot that down. "I would also like to mention that TSMC is not engaged in any discussion with other companies regarding any joint venture technology licensing or technology transfer," said Wei.

Pulling forward of demand due to tariffs? Wei said TSMC hasn't seen changes in customer behavior and there doesn't appear to be purchasing ahead of tariffs.