Bank of America is infusing AI throughout its primary units--consumer banking, global wealth and investment management and global banking and markets--and plans to spend $4 billion on new projects as its digital engagement gained throughout 2024.

The company outlined how its AI and machine learning tools, which are headlined by its Erica virtual assistant that launched in 2018, are gaining traction for multiple use cases.

Bank of America CTO and CIO Aditya Bhasan said "our use of AI at scale enables us to further enhance our capabilities, improve employee productivity and client service and drive business growth."

- As tech navigates volatility, here's what the big finance CEOs say about the economy

- Bank of America: Why 'digital superiority' matters

- Lloyds Banking Group bets on Google Cloud for AI-driven transformation

- Google Cloud, UWM partner as mortgage battle revolves around automation, data, AI

- Financial services firms see genAI use cases leading to efficiency boom

- Infosys, Persistent see trickle down demand as financial services ramp genAI projects

The bank has an annual technology budget of $13 billion and $4 billion of that sum is allocated to new AI projects in 2025. Bank of America has more than 1,200 AI and machine learning patents.

Key projects include:

- Erica for Employees was launched in 2020 and expanded in 2023 for use cases in health benefits, payroll, tax forms and HR use cases. Erica for Employees is used by 90% of workers and has reduced calls into the IT service desk by 50%.

- Bank of America said Erica for Employees will use generative AI to cover more topics.

- Ask Merrill and Ask Merrill takes the technology for Erica and uses it for curate information and data and client experiences.

- The Academy is an AI driving training platform for coaching with conversation simulators. Employees completed more than 1 million simulations in 2024 to practice client conversations.

- AI is also being used for coding assistance, client meeting prep, optimizing call centers and research.

What sticks out for Bank of America's use cases for AI is that much of the projects are aimed at experience and driving revenue growth. The employee efficiency angle to AI was added later--partially due to the benefits of generative AI.

These efforts have enabled Bank of America to grow revenue and efficiency as well as digital interactions, which can offer better experiences at lower costs.

Bank of America, like many financial services firms, reported strong first quarter results. The company reported first quarter earnings of $7.4 billion, or 90 cents a share, on revenue of $27.4 billion, up 6% from a year ago. Bank of America added consumer and global wealth and private bank accounts of 250,000 and 7,200, respectively. Average deposits grew for the seventh consecutive quarter to nearly $2 trillion.

Going forward, here are some of the trends to watch.

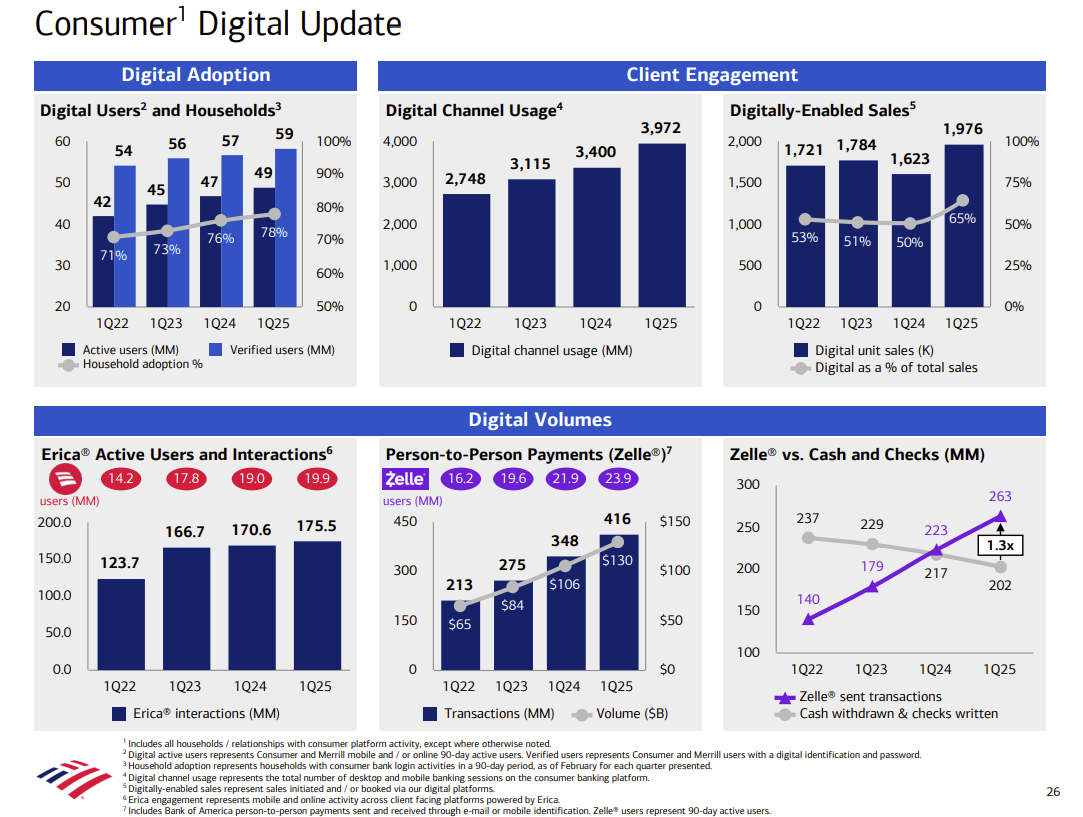

Consumer Banking

- Can Bank of America boost its digital enabled sales and to what level? In the first quarter, digital sales were 65% of the total in consumer banking.

- Can Erica interactions largely replace human interactions?

"Digital adoption and engagement continued to improve, and customer experience scores rose to record levels, illustrating the appreciation of enhanced capabilities from these investments," said CFO Alastair Borthwick.

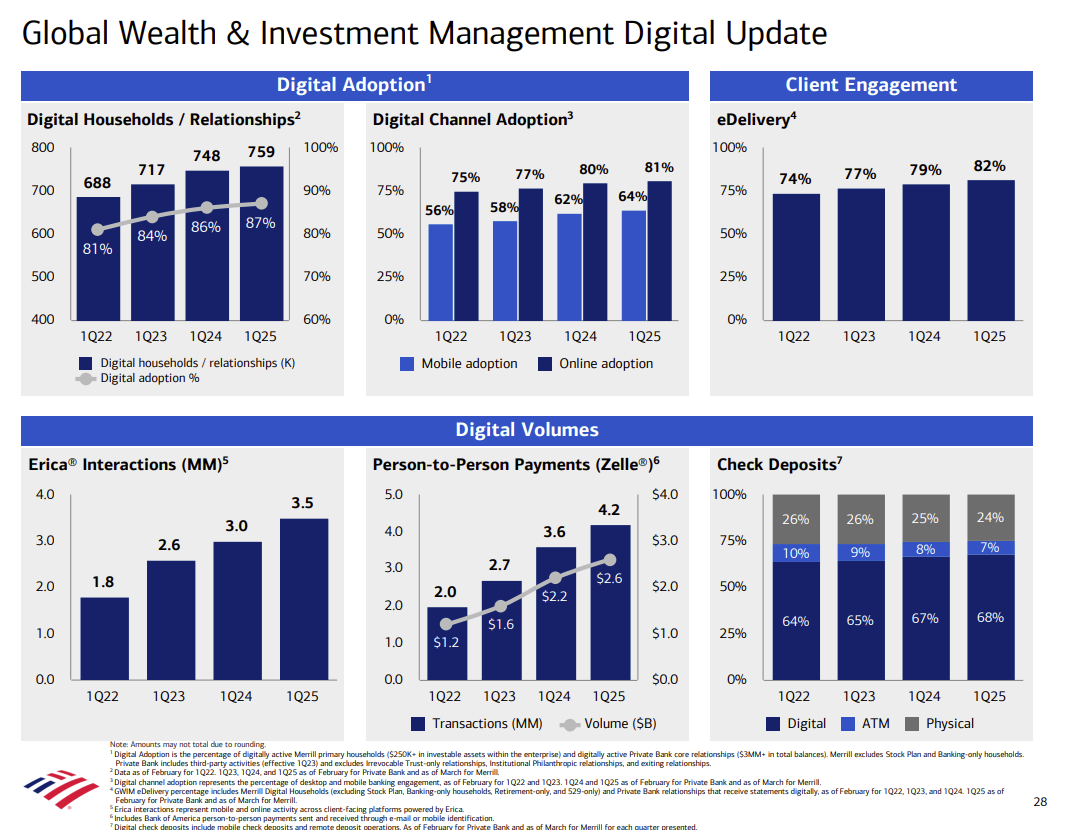

Global Wealth and Investment Management

Digital adoption reaches 87% of global wealth relationships. Can that tally get to nearly 100% as customers age out?

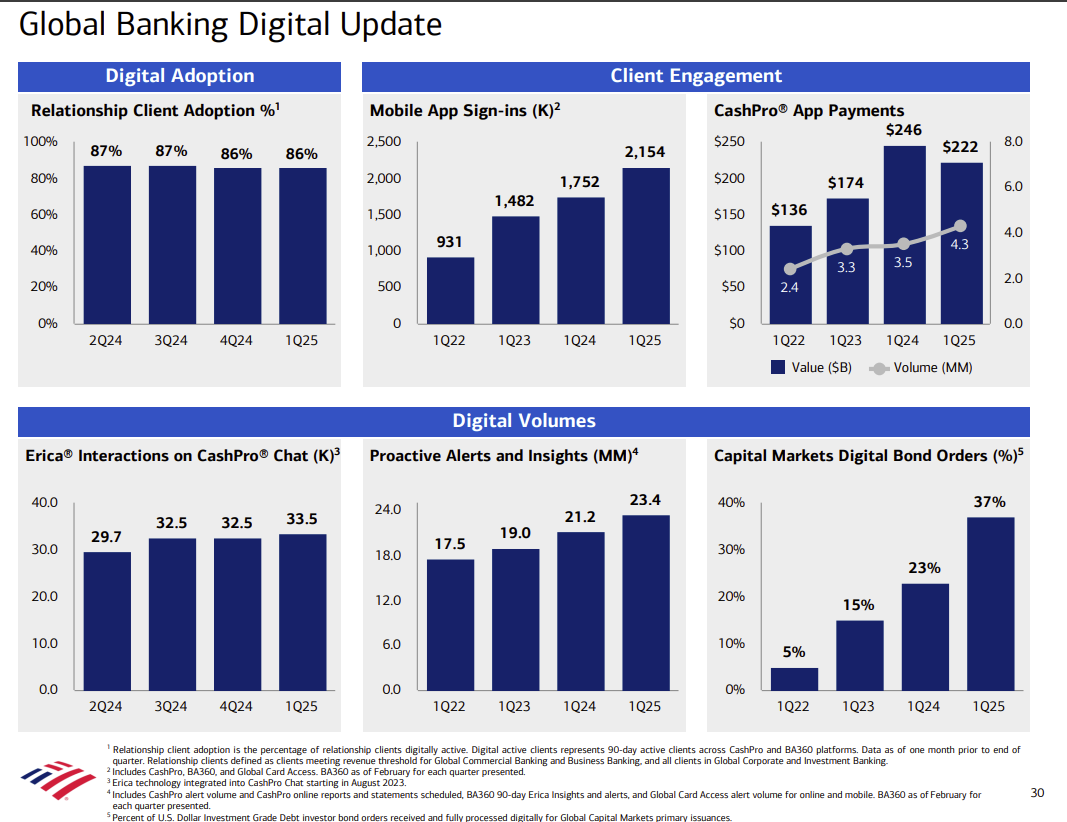

Global Banking

Digital engagement is lower for the global banking unit and may provide upside in the future.