Technology vendors are likely to start trimming their outlooks or say they are back-half loaded as macroeconomic concerns and an inability to plan due to tariffs take a toll.

Not all vendors will take the hit, but those with sizeable federal government businesses are saying March has indicated businesses may slow. Meanwhile, enterprises are likely to take longer to make decisions on technology.

It's not a groundswell of enterprise tech vendors yet with guidance cuts, but mainstream consumer companies have all noted that spending has pulled back. Delta and American Airlines noted that travel trends have slowed including business. Retailers have noted soft trends. Wireless providers including Verizon and AT&T have also said something similar.

The tripwire on economic concerns has been hit in the last two weeks. For instance, the most recent Chief Executive CEO Confidence Index fielded March 4 and March 5 found that CEOs' rating current business conditions fell 20% from January.

With an earnings barrage due in April and the first quarter closing in two weeks, it won't be surprising if enterprise tech vendors start echoing what we've just heard from those who reported in the last week.

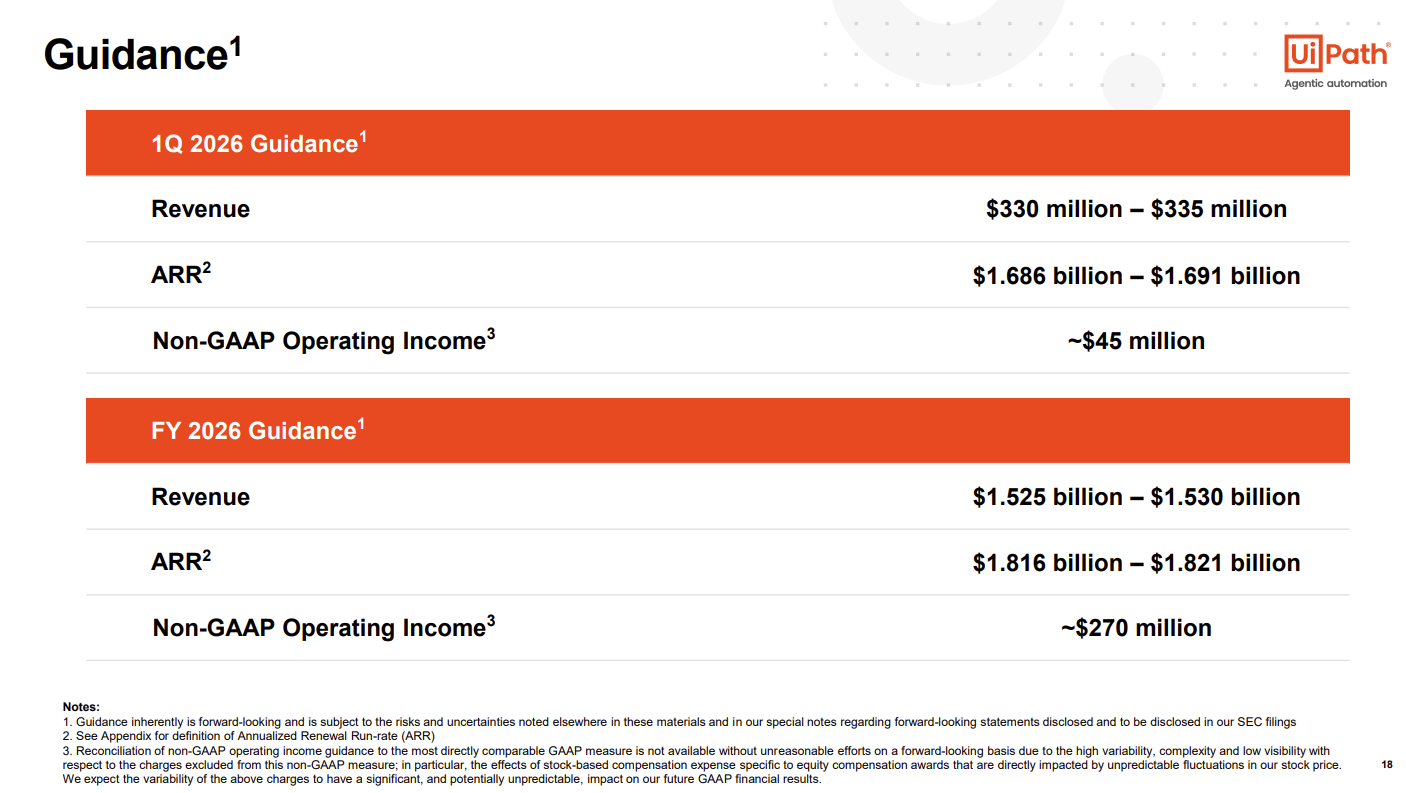

Consider UiPath. The federal government is its third largest vertical. The company's fourth quarter earnings were swell, but the outlook was off. The word "federal" was mentioned 11 times on the fourth quarter conference call. UiPath, an automation platform, said agentic 50 times, but often the future was combined with uncertain.

CEO Daniel Dines said:

"We continue to work closely with our federal customers and their feedback is consistent. Our agentic platform drives tangible efficiencies and is a part of their go-forward roadmap. At the same time, we acknowledge that in the short term, the government is working through administration priorities, which we will work to support. And we have factored this into our linearity and our overall guidance for the year. There has also been a significant increase in volatility in the overall macroeconomic environment, particularly in the last two weeks.In recent discussions with customers, the external environment has created uncertainty around their budgets. Foreign exchange rates have also significantly fluctuated over the last week. Given these trends, we are taking a measured for fiscal 2026, adding additional prudence to our overall guidance given the volatile environment. We are confident that we are appropriately factoring in the macro trends as we see them today."

UiPath Ashim Gupta said in some cases the federal government is putting moratoriums on procurement for new contracts. Gupta said UiPath feels good about the value they provide, but the company has to give DOGE and the new administration "the appropriate space to let them work through the transition and continue to demonstrate our partnership and value."

SentinelOne, a AI cybersecurity vendor, reported earnings March 12 just like UiPath did. The company's outlook was lighter than expected because it is discontinuing a product line, but SentinelOne said economic caution was warranted.

CFO Barbara Larson said:

"We're mindful of macroeconomic conditions, deal timing and federal spending uncertainty. In addition, we're focused on delivering efficiencies and that means prioritizing our investments in data, cloud and especially AI."

SentinelOne CEO Tomer Weingarten said in the long run, the federal government's focus on efficiency could be good for business. For now, the level of spending is uncertain.

Weingarten said:

"There's definitely a level of unknown and uncertainty. There's no question that there's a lot of change that's happening. With that, we've actually seen our federal pipeline expand. I would also say for the type of offering that we can cater to for federal agencies, and especially given that we're one of the only security vendors that can sell AI into a FedRAMP High type of an environment.In many cases, we actually create cost synergies. At the same time, I would say, there is maybe some unclarity on deal timing and budgets, and we're just working at the pace of the customer."

Working at the pace of the customer may become a common refrain. HPE CEO Antonio Neri also flagged federal government uncertainty, but demand is uncertain. How enterprises are impacted is also unclear at the moment. Neri said on HPE's first quarter earnings call.

"On the federal side, it depends on which agency you're working with. So far not a significant slowdown, but remember, the HPE Company provides core tech infrastructure for the Department of Defense and Department of Energy and many agencies that provide national security of sorts. And therefore, that has not been seen, but we see what happened next. Hard to predict at this point in time."

HPE Marie Myers added that the company is also trying to navigate uncertainty like most manufacturers. She said:

"Recent tariff announcements have created uncertainty for our industry, primarily affecting our Server business. We are working on plans to mitigate these impacts through supply chain measures and pricing actions. Through these efforts, we expect to mitigate to a significant degree the impact on the second half of the year and to a lesser extent the impact on Q2 as it takes time to implement mitigations."

Even for big enterprise vendors that are seen as an efficiency fix, the pause is spending is likely to be seen. ServiceNow CEO Bill McDermott said the company hasn't seen a headwind yet, but it's not unusual that federal government spending pauses a bit with a new administration. McDermott's comments were made March 3 at a Morgan Stanley investor conference.

He said:

"It's not unusual, especially with the focus on efficiency and driving that value for the citizens of The U.S. and dealing with the deficit challenges and so forth that it could be a timing situation. So, we're very transparent on that, but I haven't seen evidence of that yet. And I actually see a tremendous amount of evidence, and we've gotten this feedback incidentally, that our platform maps beautifully to attacking the cost, the assets not being fully utilized, the mission of sending people back to the office."