Palantir delivered better-than-expected fourth quarter earnings, closed 32 deals worth more than $10 million, and gained enterprise momentum.

The company reported fourth quarter net income of $79 million, or 3 cents a share, on revenue of $828 million, up 36% from a year ago. Palantir's adjusted earnings in the fourth quarter were 14 cents a share. Wall Street was looking for 11 cents share on $799 million in revenue.

Palantir also delivered a rule of 40 score of 81%. Rule of 40 refers to a SaaS metric that dictates that a company's combined revenue growth rate and profit margin should equal or top 40%.

Alex Karp, CEO of Palantir, said the company said large language models are commoditizing and the value is more about data and ontology. "Our early insights surrounding the commoditization of large language models have evolved from theory to fact,” said Karp.

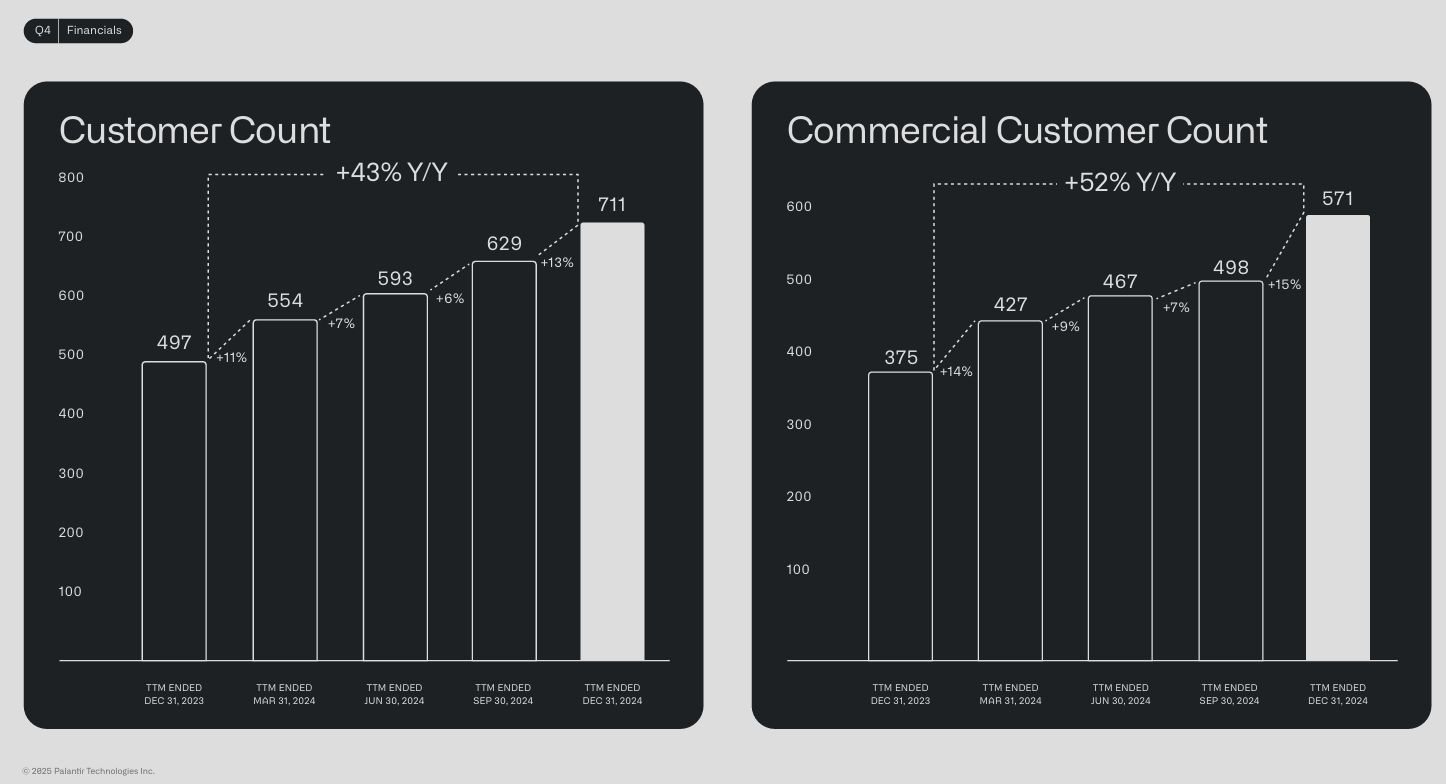

The growth for Palantir continues to come from the US and commercial sector even though its core government revenue is also strong.

In a shareholder letter, Karp said:

"This is not an incremental advance or marginal acceleration of our business. This is a new phase. We have the products and reach of an established incumbent and the speed, growth, and agility of an insurgent startup. It is that most lethal of combinations that we have been seeking to build, and the future is now coming into sharp focus. The strength of our commercial business in the United States, in particular, continues to astound even our most ardent believers."

- Lowe's betting on AI to drive customer experience, optimize multiple processes

- Here’s what technology buyers say about AI, technology, transformation

By the numbers:

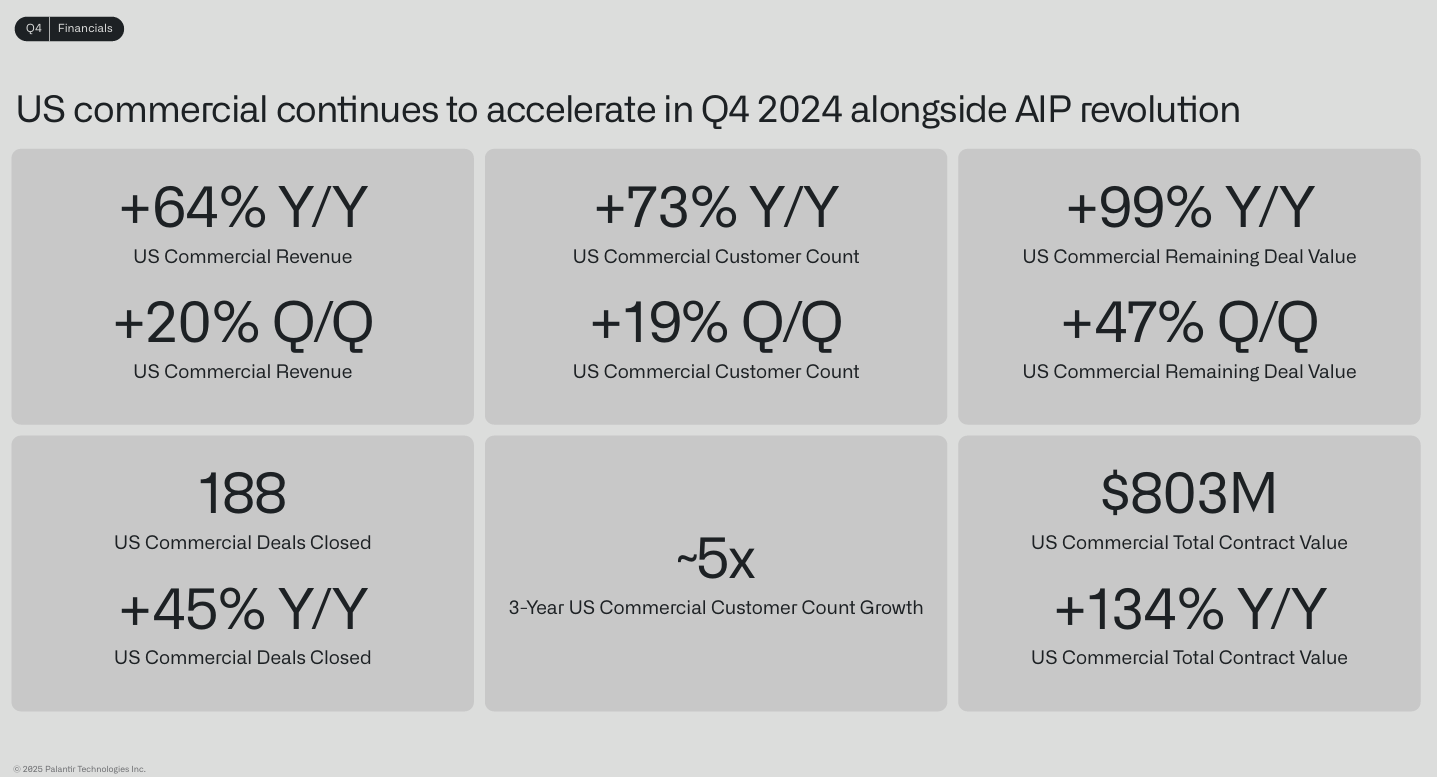

- US revenue in the fourth quarter was $558 million, up 52% from a year ago. US commercial revenue growth was 64% and government revenue growth was 45%.

- Palantir said it closed 129 deals of at least $1 million, 58 deals of at least $5 million, and 32 deals of at least $10 million.

- The company ended the fourth quarter with cash and equivalents of $5.2 billion.

For 2024, Palantir reported net income of $462 million, or 19 cents a share, on revenue of $2.865 billion, up 29%. The company has continued deliver strong results and land enterprises.

- Palantir Q3 strong amid strong AI demand; Karp says 'we intend to take the entire market'

- Lowe's bets on AI, technology to navigate slowing demand

- Disruption is coming for enterprise software

- Palantir to deploy platforms on Microsoft Azure

- Palantir will move workloads to Oracle Cloud as both court governments and enterprises

- Palantir Q2 shines as US enterprise growth accelerates, eyes manufacturing, ERP with Warp Speed

As for the outlook, Palantir projected revenue between $858 million and $862 million with adjusted income of operations between $354 million to $358 million. For 2025, Palantir is projecting revenue between $3.74 billion and $3.76 billion with US commercial revenue of $1.08 billion, up at least 54%. Palantir projects GAAP net income in each quarter.

Karp in his shareholder letter continues to take a victory lap.

"We have been preparing for this moment diligently for more than twenty years. A certain indifference to the doubts and opinions of others, to the shiny and fashionable thing, was absolutely required. But our patience, and what some would fairly describe as our disregard for the received wisdom, has been rewarded."

Constellation Research analyst Holger Mueller said:

"Palantir had a good quarter, and it manages to show impressive growth rates. The 'dirty secret' is though - it is growing slower than the cloud provider growth rates. Enterprises are buying compute and storage for a 'do it yourself' approach at a higher rate than Palantir can convince them to use their platform and tools. The verdict is still out for the fiscal year if this is the toolset, professional services or both."

The power of ontology

Speaking on the earnings conference call, Karp said Palantir's approach to data ontology is its secret sauce. Ontology is what allows you to manage the LLMs to be more exact at scale.

"To get the AI to actually work in an enterprise, you have to re-segment, re-concatenate the large language models in a way where the use-case is thin enough that they can actually provide exact enough information and the concatenation of that is exact enough to provide real results in an enterprise context," said Karp. "In order to be able to teach a large language model to get more exact precise information, you would have to have a secure and clean access to the underlying data of the enterprise. No other company in the world has that kind of access like Palantir."

Ryan Taylor, Chief Revenue and Legal Officer, said the proliferation of AI models means the "raw AI labor supply is exploding." Taylor added that "while everyone else is focused on the model supply side, we're transforming AI into a measurable stream of high-value finished goods and services."

Taylor added that Palantir ability to weave LLMs into their enterprise and unlock AI leverage is helping enterprises execute faster. "Most organizations are currently stuck on the wrong side of the widening chasm, working on their two, five, and 10-year plans, which become obsolete days later failing to ever take action," said Taylor.

CTO Shyam Sankar said Palantir is in a strong position to take advantage of LLM commoditization and noted "the cost per token for inference continues to drop." The emergence of DeepSeek-R1 drove the commoditization theme home.

Sankar said:

"We viewed LLMs as a new runtime for the AI labor to capture the productive value of this AI labor, you need an intermediate representation of your enterprise that AI can actually interact with.

We are convinced the normative value for AI is enterprise autonomy, the self-driving company. Users go from performing the workflow to supervising an army of agents, teaching them how to handle edge cases and reducing 12-time, this is where we are maniacally focused with our customers."