Databricks expects to have a $3 billion annual revenue run rate exiting its fourth quarter ending Jan. 31. The company also has more than 500 customers consuming more than $1 million annually.

The data and AI company disclosed its financial data in a press release announcing a $10 billion capital raise that valued Databricks at $62 billion. Databricks is also delivering positive cash flow.

In addition, Databricks, which counts Rivian, JPMorgan Chase and JetBlue as customers, said it grew revenue more than 60% in the third quarter. The company added that Databricks SQL, the company's data warehousing service, was on an annual revenue run rate of $600 million, up more than 150% from a year ago.

Databricks' disclosure provides a few interesting comparisons.

- In September 2023, Databricks was valued at $43 billion and had an annual revenue run rate of $1.5 billion with 50% growth. The company also had more than 300 customers consuming $1 million.

- Snowflake's valuation currently is $57 billion.

- And Snowflake's annual revenue run rate exiting its most recent quarter is $3.77 billion.

Databricks said its Series J funding round will be non-dilutive. The round was led by Thrive Capital and investors Andreessen Horowitz, DST Global, GIC, Insight Partners and WCM Investment Management.

According to Databricks, the capital will be used to fund new AI products, acquisitions and international expansion. The capital will also be used to enable current and former employees to cash out.

Ali Ghodsi, Co-Founder and CEO of Databricks, said the company's funding round was "substantially oversubscribed" and the company is "positioning the Databricks Data Intelligence Platform to deliver long-term value for our customers."

- Databricks, AWS expand partnership with Mosaic AI, more integration

- Databricks acquires Tabular to bridge Iceberg formats with its lakehouse

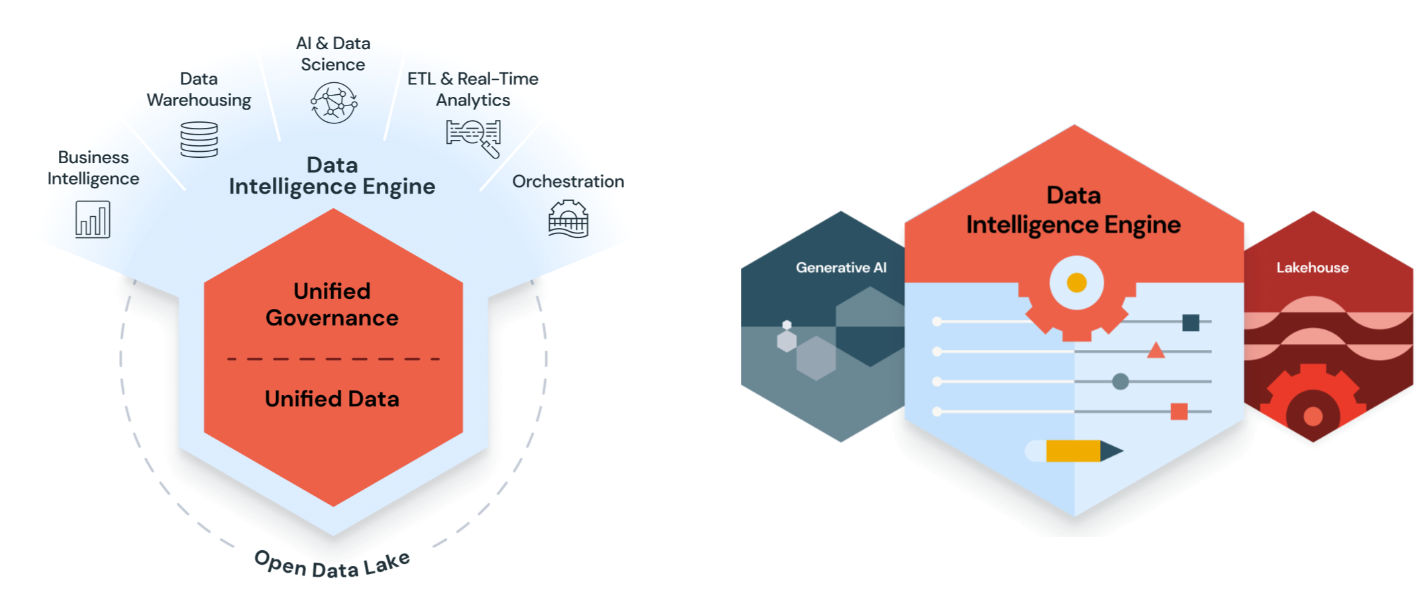

- Databricks launches Data Intelligence Platform, melds data, AI workflows