Broadcom reported better-than-expected fourth quarter earnings as its AI revenue continued to surge.

The company reported fourth quarter net income of $4.32 billion, or 90 cents a share, on revenue of $14.05 billion. Non-GAAP earnings for the quarter was $1.42 a share.

Wall Street was expecting Broadcom to report non-GAAP earnings of $1.39 a share on revenue of $14.06 billion.

As for the outlook, Broadcom projected first quarter revenue of $14.6 billion, up 22% from a year ago. Broadcom also raised its quarterly stock dividend by 11% to 59 cents a share in fiscal 2025.

Broadcom CEO Tan takes VMware victory lap: Will he go shopping again? | Rivals up pressure on VMware for enterprise migrations

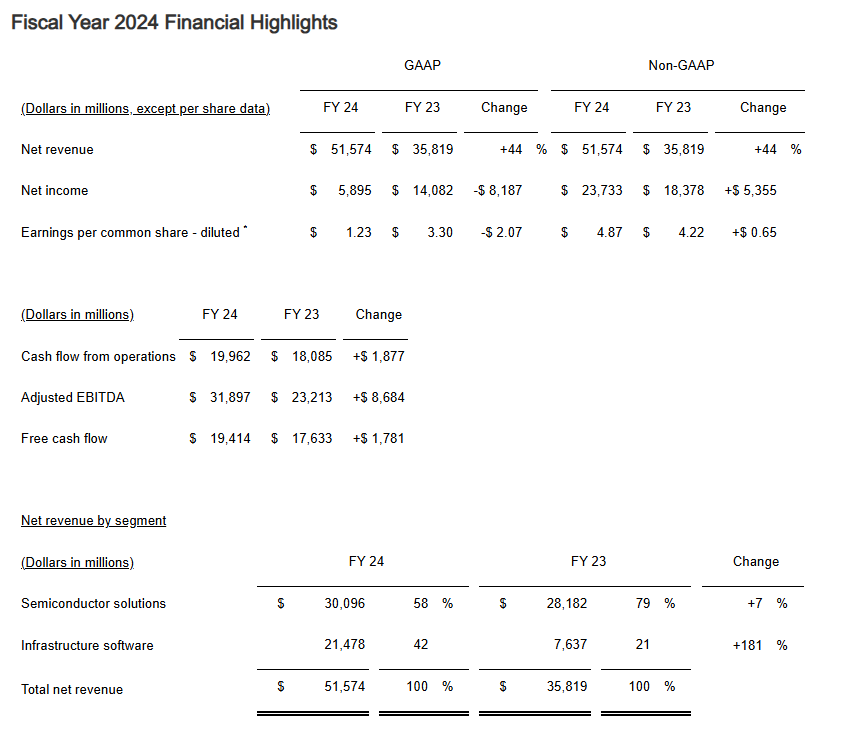

Fourth quarter semiconductor revenue of $8.23 billion, was up 59% from a year ago. Infrastructure software, which is dominated by VMware, was $5.82 billion, up 196% from a year ago due to the VMware acquisition.

For fiscal 2024, Broadcom reported revenue of $51.57 billion, up 44% from a year ago, with net income of $5.89 billion, down from $14.08 billion a year ago.

CEO Hock Tan said semiconductor revenue hit a record $30.1 billion in fiscal 2024 with AI revenue of $12.2 billion, up 220% from a year ago. Tan said AI revenue "was driven by our AI XPUs and Ethernet networking portfolio."

In the fourth quarter, software accounted for 41% of total revenue. A year ago, software was 21% of Broadcom's revenue.

Constellation Research analyst Holger Mueller said:

"Broadcom had a very good quarter year over year thanks to the popularity of its AI chips and the consolidation of the VMware business. And while the AI business will keep growing for Broadcom, which according to CEO Hock Tan has major design wins recently. We already know Google Cloud is a customer, and even Apple might become one. The revenue diversification with the VMware acquisition has made Broadcom more resilient, with semiconductors now 60% of revenue compared to about 80% a year ago.

The naysayers of the VMware acquisition need to tip their hat to Tan, who integrated the company in 12 months. And while everybody is chasing VMware customers, the skeptics will have to learn that re-certification of containers is an expensive business for enterprises. People keep complaining about VMware, but it hasn't seen major defections yet. Meanwhile, Broadcom may increase discounts if the customer attrition becomes painful."