Walmart's ongoing bets in technology, AI, automation and omnichannel customer experiences are paying off as the retailer lands more share among higher-income shoppers.

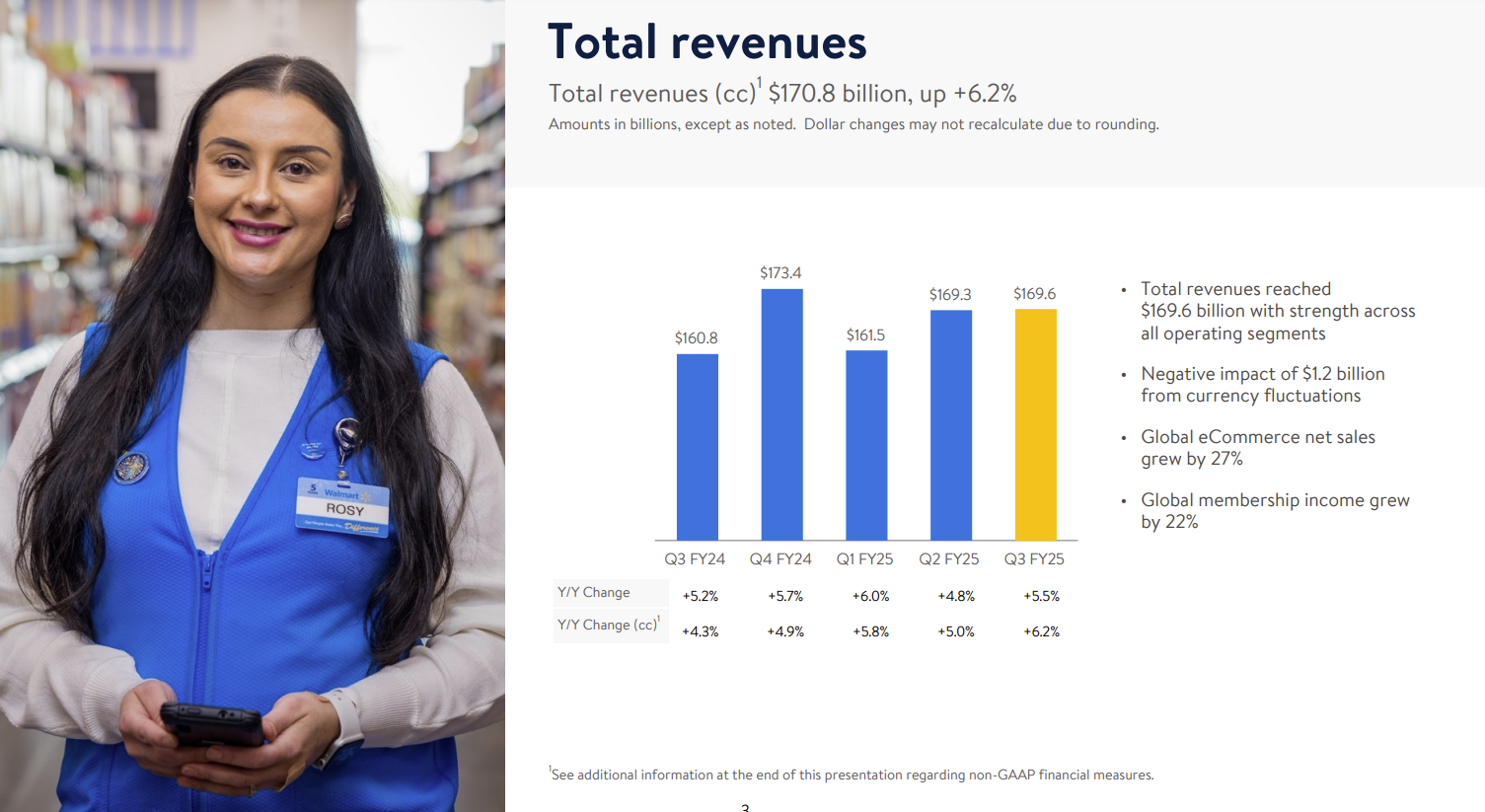

The company's third quarter earnings report illustrated the art of delivering results today while transforming the company. Walmart delivered third quarter earnings of 57 cents a share, 58 cents adjusted, on revenue of $169.6 billion, up 5.5% from a year ago.

Walmart also raised its sales growth outlook for fiscal 2025 to 4.8% to 5.1%. In February, Walmart was projecting fiscal 2025 sales growth between 3% and 4%. The retailer also raised its non-GAAP earnings target to $2.42 a share to $2.47 a share.

By revamping its sales mix and squeezing costs while keeping prices low, Walmart has been able to grab wallet share. In the third quarter, Walmart's e-commerce revenue was up 27%, advertising sales were up 28% and membership income gained 22%.

"The rapid growth from newer businesses is helping us strengthen our business model," said Walmart CEO Doug McMillon. "Households earning more than $100,000 made up 75% of our share gains. In the U.S., in-store volumes grew, curbside pickup grew faster, and delivery sales grew even faster than that."

- Amazon vs. Walmart: 8 innovation takeaways

- Walmart CEO McMillon highlights adaptive retail, applied AI at CES 2024

- Walmart, Target highlight intersection of supply chain, customer experience

Walmart's performance comes as the company is seeing margin pressure from GLP-1 drugs and weathered a US port strike, two hurricanes and flooding. Inventory is in good shape, said McMillon.

Here's a look at some the technology investments that are paying off for Walmart.

Tech talent. "We build tech more effectively than we used to, and we're doing it with more speed," said McMillon.

Scan & Go and computer vision checkouts. Sam's Club's Scan & Go app is driving throughput at Sam's Club. Walmart is likely utilizing Scan & Go at Sam's Club locations before expanding.

CFO John David Rainey said:

"Scan & Go penetration of sales increased more than 250 basis points and the nearly completed rollout of our Just Go exit technology across all 600 clubs is enabling about 70% of members to exit without a check. Members love it with member satisfaction scores on exit now close to 90."

International best practices. Half of Walmart's sales in China are digital and it can provide 1 hour delivery service. McMillon also said that the company has learned from social commerce in China as well as India, which has disruptive fintech at scale.

Generative AI. Walmart continues to advance its genAI efforts to deliver what McMillon called "practical opportunities right in front of us." He said:

"Our datasets are valuable and we're learning to put them to work to improve the customer member experience and assist our associates as they do their daily work. I'm excited about how (generative AI) will improve the customer experience in the months and years to come, enabling us to provide a better experience than the one that starts by typing into a search bar and getting a list of results to choose from. We're racing to improve all the things that people love about shopping and remove or diminish all the things they don't."

GenAI is also removing friction for employees, said McMillon.

Automation. Rainey said that more than half of Walmart's fulfillment center volume is automated, twice as much as last year. "This has the obvious benefit of lowering the per unit cost of delivery. These factors contributed to the third consecutive quarter of approximately 40% reduction in U.S. net delivery cost per order," he said.

Omnichannel experiences. Rainey noted that Walmart is gaining higher-income shoppers in part because of the company's focus on omnichannel retailing. Rainey said:

"We talk about the different ways that we can serve consumers and how that's different from say, a decade ago or even five years ago. As we've become omni, we have the ability to sell customers in the store or at the curb, deliver to their home and we can do that whenever and however they want. We want it to be a great price and we want it to be convenient and we can do both at the same time."

From here, McMillon said Walmart will continue to balance growth, profit and investments in people and technology as well as automation, but it's real time conversation.

Rainey added:

"We feel like we're striking the right balance between profit expansion and investment in the business. We're all very focused on making sure that we are healthy for the next generation. We certainly provide an outlook over the next three to five years, but we want to continue to have the same type of financial performance after that and that requires a level of investment in the business."