Figma filed for an initial public offering, named ServiceNow CEO Bill McDermott to its board and highlighted its revenue growth as investors got to see why Adobe wanted to buy the company for $20 billion.

According to a filing with the Securities and Exchange Commission, Figma reported first quarter net income of $44.9 million on revenue of $228.2 million, up 46% from a year ago. As of March 31, Figma had 1,031 customers contributing at least $100,000 per year in revenue. The company announced the IPO filing and McDermott joining the Figma board on its blog.

Figma, which saw a $20 billion acquisition by Adobe fall apart due to regulatory concerns, said it is targeting the teams that bring together applications, websites and digital experiences. What remains to be seen is how Figma winds up competing with Adobe, the company that tried to acquire it.

One thing is clear: Figma, which will trade under the ticker "FIG," is hitting the IPO market at a good time. Coreweave and Circle have had strong debuts. CEO Dylan Field has 56.6 million Class B shares and 51.1% voting power ahead of the IPO.

Constellation Research analyst Liz Miller said:

"The S-1 is truly the first step in the next chapter for Figma’s growth and diversification as the player to beat in design software, capturing the hearts and minds of users and increasingly, the ecosystems that are dependent on digital product optimization. With this new direction in mind, the IPO and the growth of their board with industry icons like Bill McDermott add to the sheen of Figma’s pride in disruption. This is a team that is focused on bringing disruption to the design market by delivering the modern, digital, collaborative tools that their users dream of, not the tools their users have to learn and muddle through. Take introductions of tools like Figma Slides. On paper, investors may look and say, OK, yeah…slides. But it got users out of their seats craving the innovation, the ease of use and the disruption.

Figma has grown its partnerships and integrations to extend the very idea of creation and collaboration to seamlessly work beyond the confines of Figma. The partnership and native integrations with UserTesting are a great example of this where products can gather realtime user feedback and investigate with a customer panel, update product and push directly to Figma. The integration turns to struggle resolution into an optimization opportunity without pain, friction and multiple team handoffs and timely approval rounds. Other recently unveiled partnerships include folks like HCL TX portfolios. That HCL TX partnership allows web and mobile designers to directly address web and application appearance from within Figma while integrating with HCL Software’s Customer Data Platform to deliver personalized experiences. I’d expect to see more opportunities to extend Figma design and collaboration through partnerships in the future."

Here's what you need to know about Figma.

The target market. Figma targets cross-functional teams behind products including designers, product managers, researchers, marketers, writers and a bevy of non-designers. Figma has 13 million active monthly users with 95% of the Fortune 500 using the company's platform.

Revenue growth. Figma said 2024 revenue was $749 million, up 48% from a year ago, with a net loss of $732.1 million.

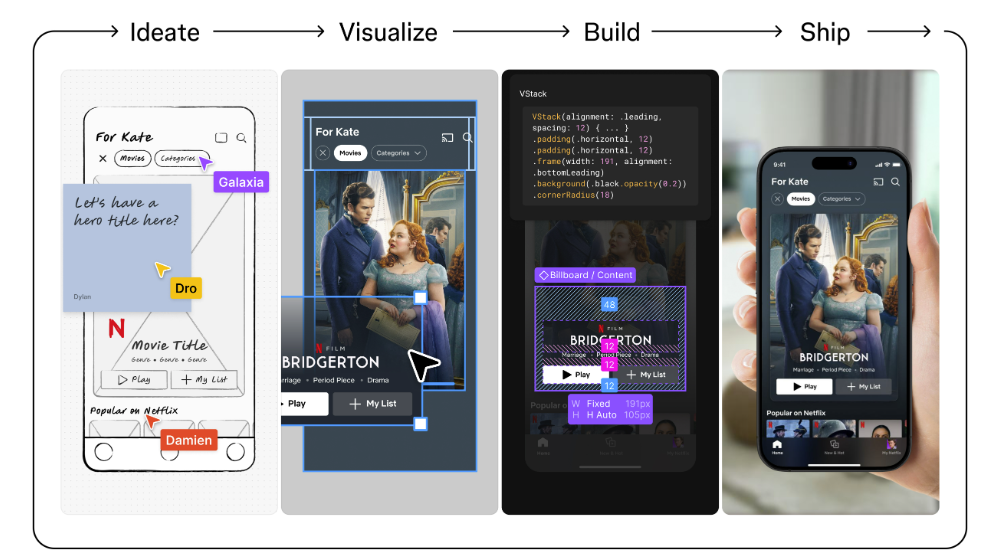

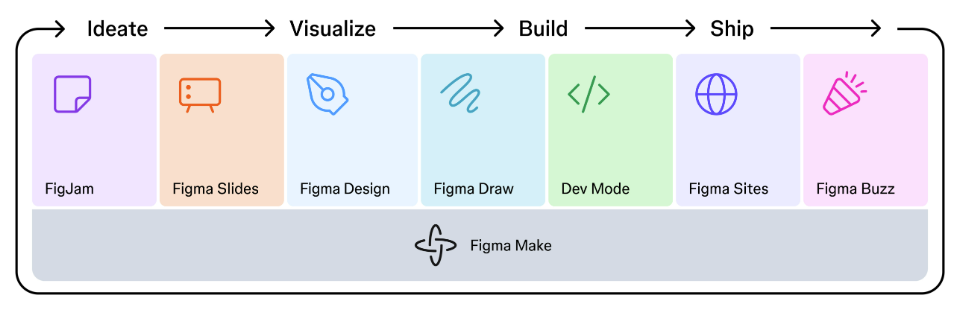

The product. Figma started as a browser-based design system and has evolved into a broad platform to move products from idea to design to production.

The AI strategy. Figma said in its IPO filing that AI is transforming the product development process. Figma said:

"We believe AI is fundamentally transforming the product development process by making it possible for anyone to quickly turn an idea into a functional prototype, or in some cases, a working product. Figma Make is our product for this new paradigm. Instead of going from idea to wireframe to mock-up to prototype iteratively, Figma Make lets users go directly from prompt to working prototype, at which point they can immediately validate an idea and choose to iterate on it, or discard it altogether. While it’s possible for AI to get to working software with a simple prompt, we believe that the most important differentiator is craft — ensuring that the product looks, feels, and works 'just right.'"

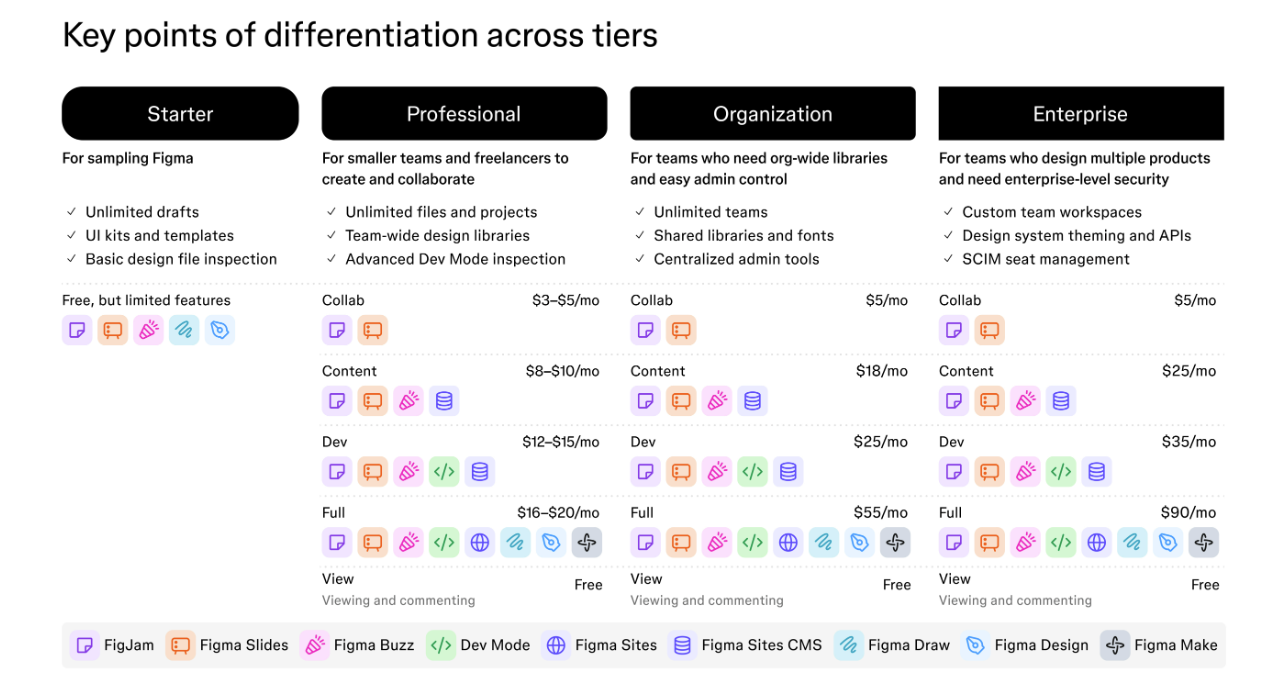

The model. Figma is a software subscription business where access is sold annually or monthly per seat with options for viewers, collaborators, content creators and developers. The sales process is automated and self-serve with starter plans to move users down the funnel. A direct sales team is focused on businesses. Figma said over time it will consider add-on pricing and models based on feature usage.

According to Figma, the seat model is a risk factor as AI is integrated into its software. New pricing and packaging launched in March are another risk factor.

Employees. Figma said it has 1,646 employees as of March 31, up from 1,014 at the end of 2022.

Cloud infrastructure. Figma runs on AWS and the company noted that its hosting costs are expected to increase as its customer base grows.

Named customers. Figma's named customers in the IPO filing includes ServiceNow, Netflix, Stripe and Duolingo among others.