This post first appeared in the Constellation Insight newsletter, which features bespoke content weekly and is brought to you by Hitachi Vantara.

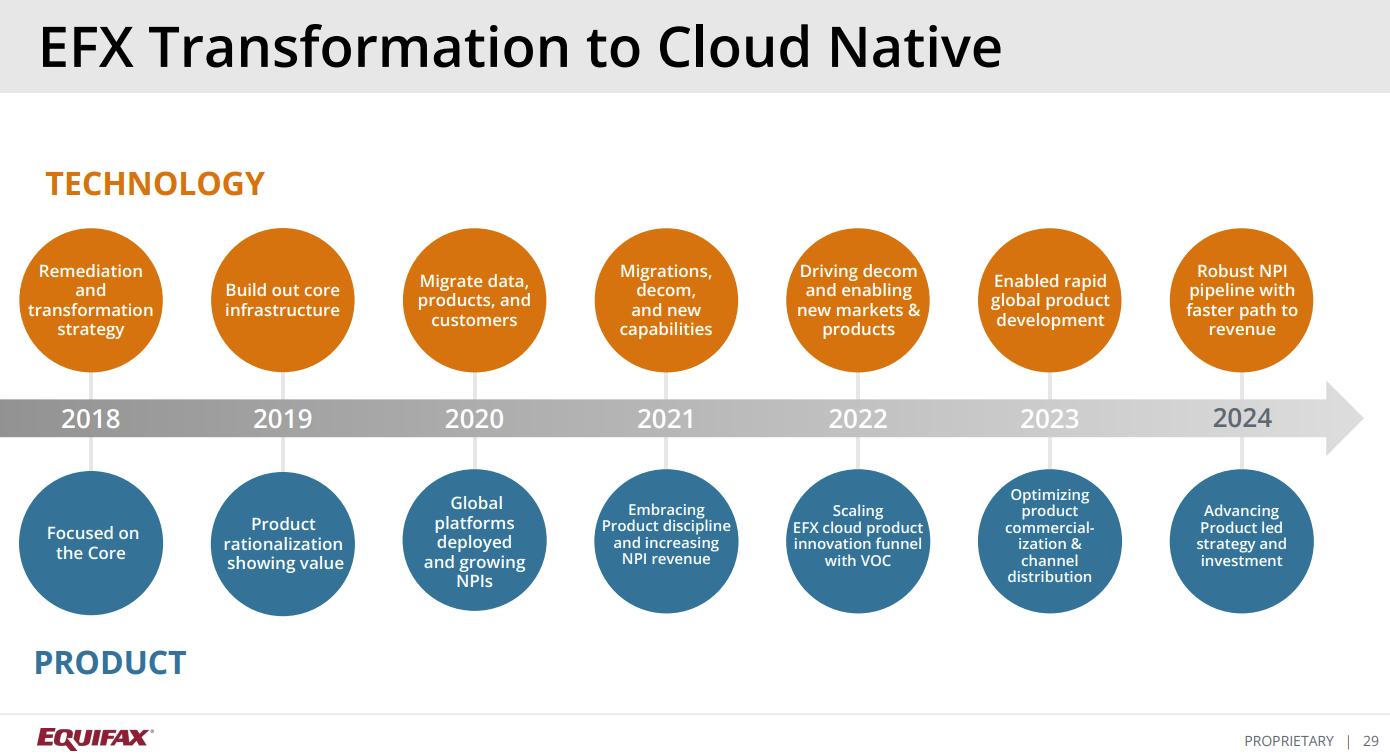

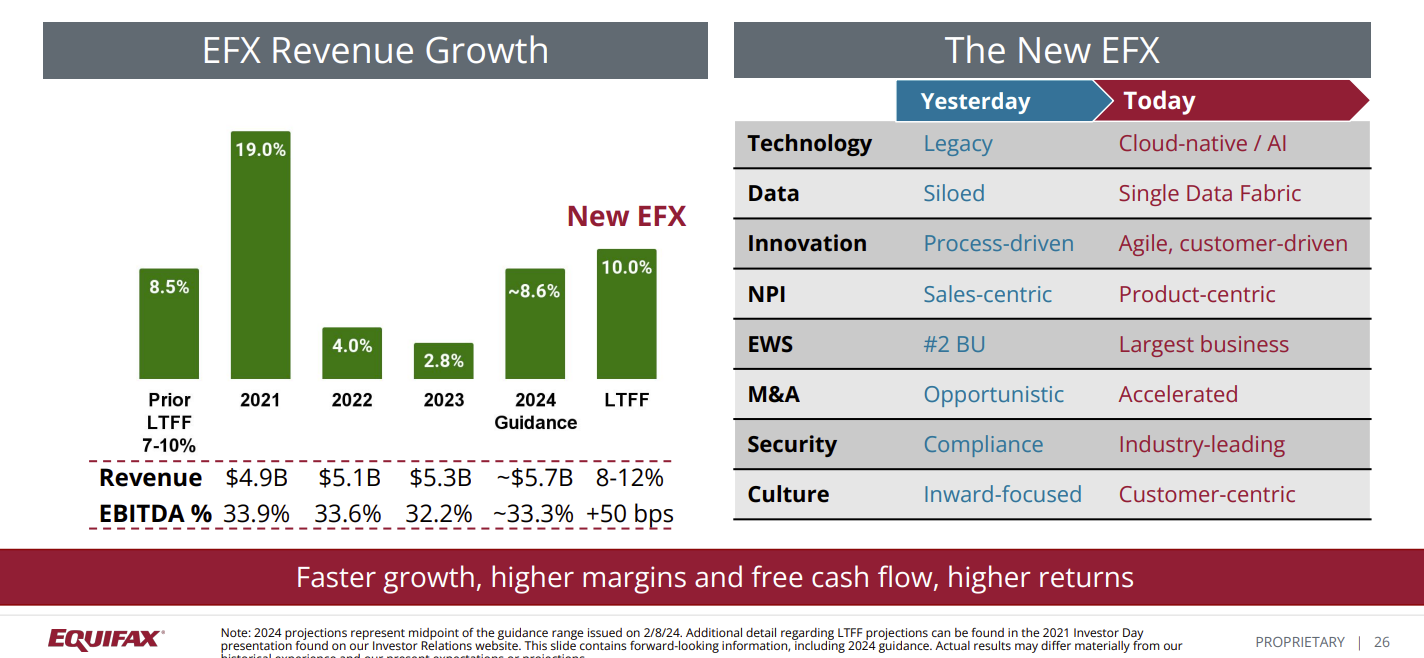

Equifax in 2024 will decommission mainframes and data centers in North America as it largely completes a cloud transformation that dates back to 2018. Now Equifax CEO Mark Begor is looking for more product velocity, artificial intelligence capabilities and competitive advantage.

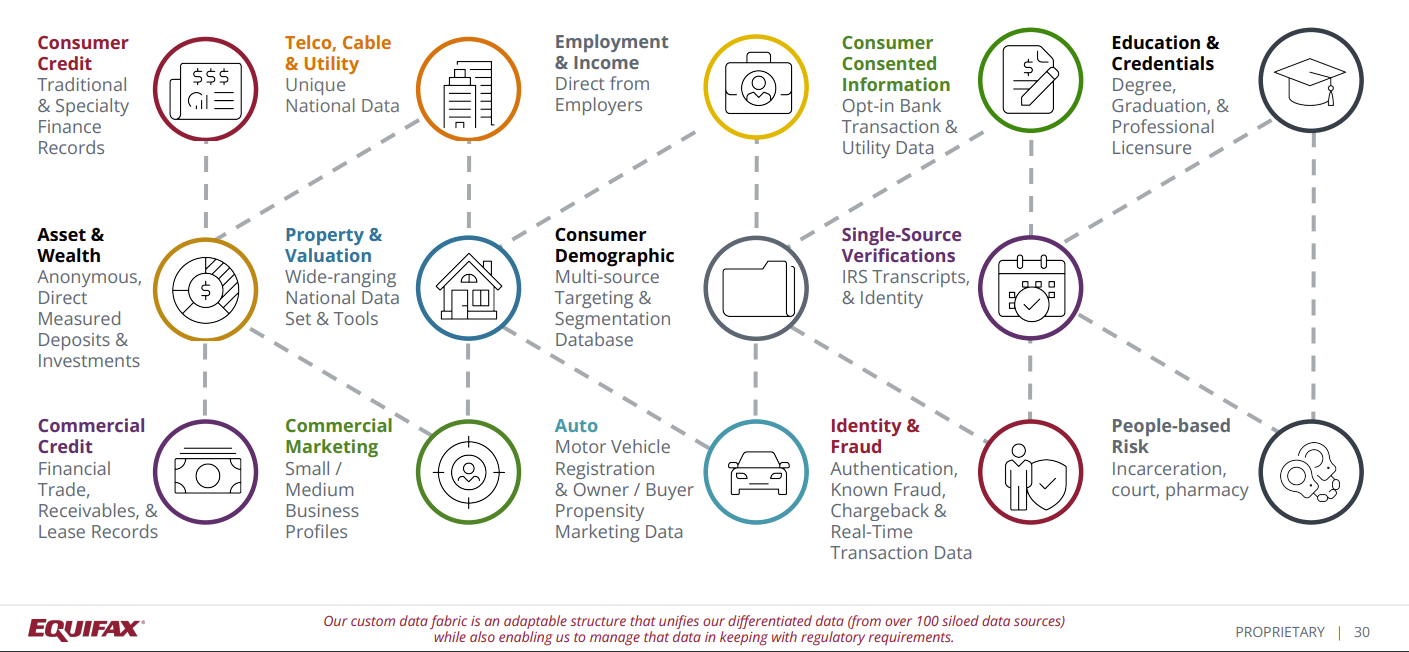

The Atlanta-based giant is best known as a credit reporting agency but has a portfolio of products via an insights engine powered by multiple data stores financial services, mortgage, commercial and residential real estate, auto, healthcare, government and employer services to name a few.

Begor, speaking on Equifax's fourth quarter earnings call noted that cloud-enabled AI using a combination of proprietary models and Google Cloud's Vertex AI will enable the new Equifax.

BT150 Interview: Equifax's Manish Limaye on data architecture, transformation

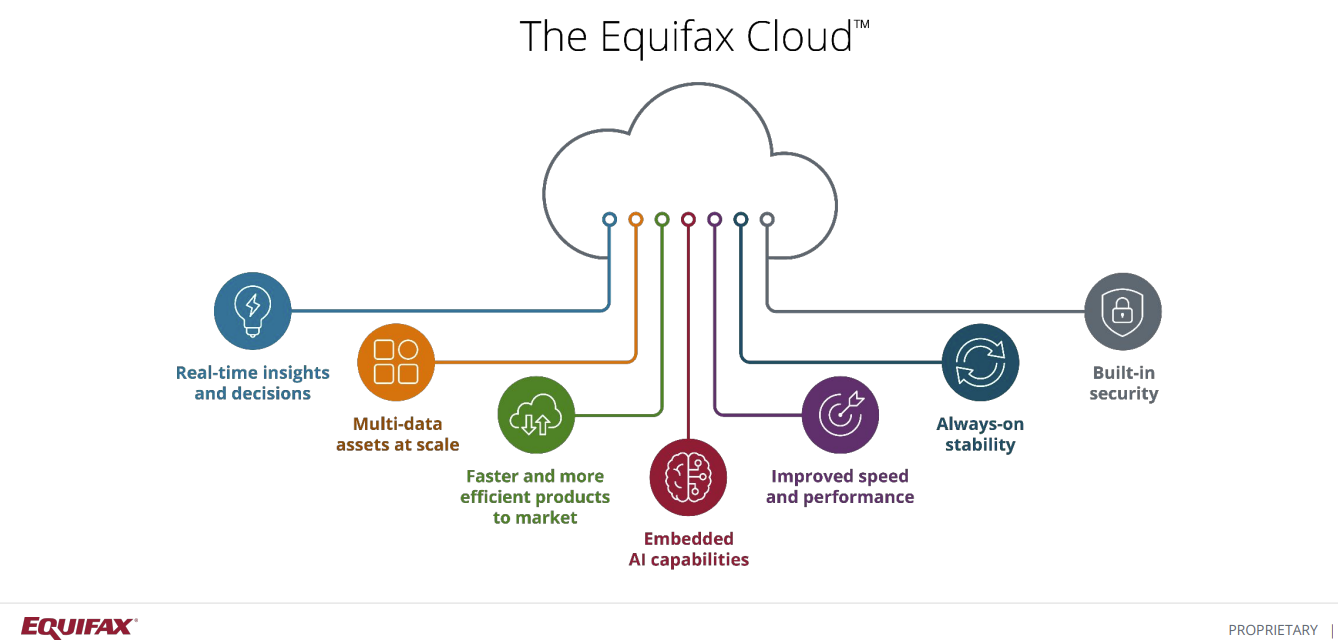

"We are convinced that our new EFX cloud single data fabric and AI capabilities are delivering new differentiated products faster with better performance and will provide a competitive advantage to Equifax for years to come," said Begor.

Equifax's journey highlights how cloud migration, digital transformation and data architecture are required to move AI efforts ahead. Equifax has also invested in transformation as its mortgage business has suffered due to rising interest rates. Fewer refinancing and home mortgages mean less Equifax data services.

Among the key milestones for Equifax in 2023:

- 70% of Equifax revenue is in the new Equifax Cloud.

- Equifax decommissioned 7 data centers and migrated 37,000 customers to Equifax Cloud.

- Saved more than the targeted $210 million goal.

And in 2024, Equifax plans on the following:

- Completing the North America move to the cloud and migrate all customers to Equifax Cloud.

- Decommissioning mainframes completely as well as remaining North American data centers.

- Progressing with transformation efforts in Europe and Latin America.

- Saving an incremental $90 million a year in 2024.

- And have about 90% of revenue in Equifax Cloud with the majority of new models and scores being built with Equifax AI.

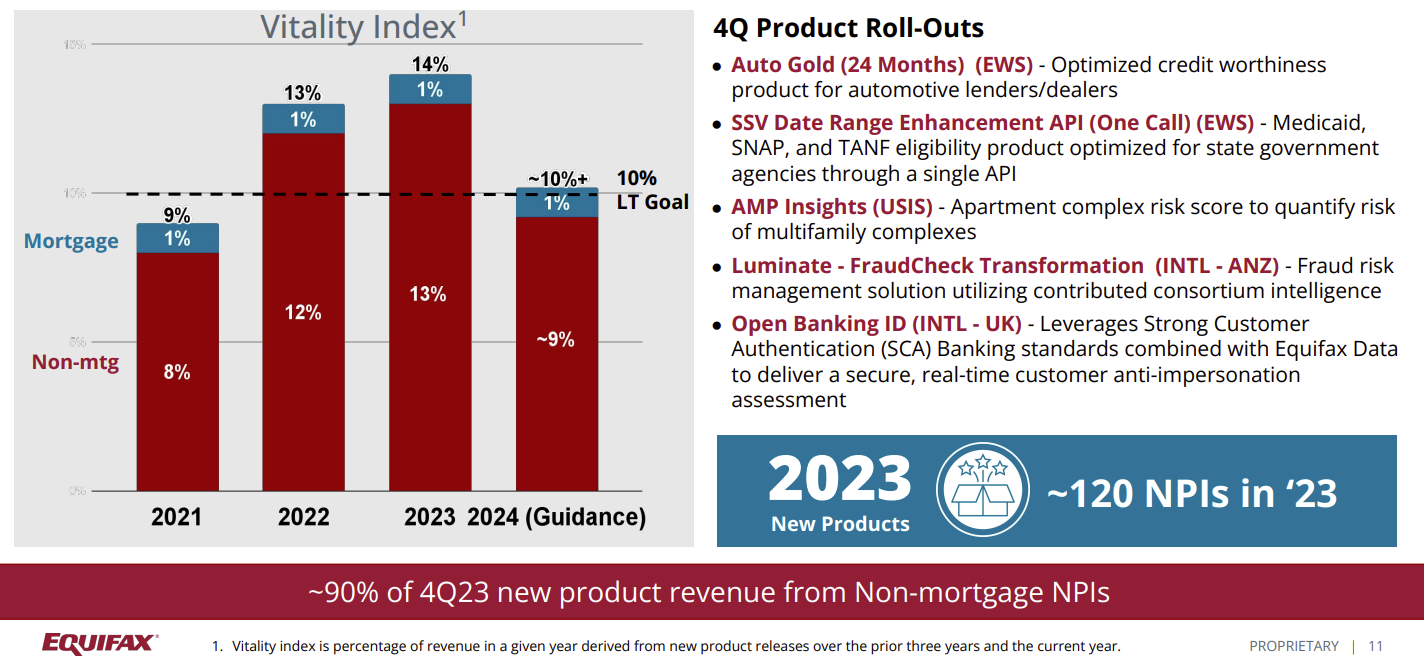

Begor noted that the cloud enabled Equifax has launched more than 100 new products a year for the last four years. In addition, average revenue per new product is up nearly 50% since 2021.

For 2023, Equifax reported net income of $545.3 million on revenue of $5.26 billion, up from $5.12 billion in 2022. The company's divisions include Workforce Solutions, Online Information Solutions, Mortgage Solutions and Financial Marketing Services.

Equifax cloud's journey

In 2021, Equifax outlined Equifax Cloud, a cloud native architecture designed for highly regulated data workloads. The launch of Equifax Cloud took $1.5 billion in investment.

Equifax Cloud was primarily built on Google Cloud, but Equifax in its annual report does cite Amazon Web Services and other vendors used for outsourcing.

According to case studies from Google Cloud and AWS, Equifax uses Google for its cloud data architecture and AWS to host mission critical applications.

Equifax said it built Equifax Cloud because it needed to build something once and then deploy across its markets with customizations that required little engineering.

Manish Limaye SVP, USIS Chief Architect & Head of Data Engineering Equifax, said in an interview at Constellation Research's Connected Enterprise 2023 the Equifax decision to build on Google Cloud had a lot to do with machine learning and AI expertise.

Limaye, a BT150 member, said:

"Equifax is deep into statistical modeling. AI, you knew was going to be big. We were one of the leaders in the explainable AI space. When we partnered with Google, it was more than just what I'd call run of the mill cloud transformation. We wanted a deep partnership with Google beyond Google Cloud into data engineering. We partner with them. We learn from them. They learn from us because we have the most complex data. There's also the value and security of the data."

The company's cloud transformation also had a lot to do with security. Equifax has argued that a distributed cloud architecture reduces the attack surface.

In Sept. 2017, Equifax announced a data breach that exposed 147 million people. The company settled with various regulators for $425 million to help people affected by the breach.

Limay said Equifax vowed to be a security leader after its data breach.

"That security commitment really meant rethinking and reimagining how we look at securing our data given the sensitivity of it. We came up with a proper security control framework and paired it with our cloud native capability. There is an ability to destroy and rebuild data at any time. When you pair security frameworks and cloud together you walk away with a very comprehensive security framework. That control framework gets translated into a series of technical requirements. It's a very rigorous process."

Equifax CFO John Gamble said the company will gain operating leverage in the second half of 2024 due to the cloud migration. "In 2024, cost savings we will generate from decommissioning of North American infrastructure in the second half of '23 will exceed the redundant system and migration costs we are incurring, generating about 30 basis points of margin benefit," said Gamble.

For Begor, Equifax's cloud transformation is also evaluated based on new product releases. Equifax tracks a Vitality index, which is a percentage of revenue in any given year derived from new product releases over the previous three years and current year.

Equifax's multi-cloud approach reshuffles vendors

As Equifax's cloud transformation evolved so did its contracts and core vendors.

Starting in its 2019 annual report, Equifax began showing cloud payments to Google Cloud and AWS. Its 2018 annual report focused on payments to IBM, which was cited as a key vendor.

Equifax also noted that its cloud transformation was also a risk. The company said in its 2019 annual report filed with the Securities and Exchange Commission: "We are transitioning and migrating our data systems from traditional data centers to cloud-based platforms. This initiative will place significant strain on our management, personnel, operations, systems, technical performance and financial resources and internal financial control and reporting function. In addition, many of our existing personnel do not have experience with native cloud-based technologies and, as a result, we have and will continue to hire personnel with such experience. This effort will be time consuming and costly."

Here's the breakdown of Equifax's vendor roster from 2018 to 2023:

2018: Equifax said it had separate agreements with IBM, Tata Consultancy Services, Fidelity Information Services and others to "to outsource portions of our computer data processing operations, applications development, business continuity and recovery services, help desk service and desktop support functions, operation of our voice and data networks, maintenance and related functions and to provide certain other administrative and operational services." Equifax said it paid IBM $49 million in 2018, $40 million and 2017 and $45 million in 2016.

2019: Equifax added Google and Amazon Web Services as core vendors along with IBM and Tata Consultancy Services. Equifax's future minimum contractual obligation to its technology vendors at this point was $296 million. IBM was paid $52 million in 2019. Equifax noted that its payments to technology vendors could vary based on the volume of data processed and "significant new technologies."

The company said it paid Google $14 million in 2019, up from $7 million in 2018. Payments to AWS weren't disclosed.

2020: Equifax had agreements with Google, AWS, IBM, Tata Consultancy Services and others for portions the functions outlined in previous years. Equifax's future minimum contractual obligation to its technology vendors was about $318 million at the start of 2021.

Equifax outsourced mainframe and midrange operations, help desk service, desktop support and network operations to IBM in various regions. IBM was paid $50 million in 2020. By this time, Google started gaining wallet share. In 2020, Google was paid $29 million, more than double its 2019 payment.

2021: Equifax again cited Google, AWS, IBM and Tata Consultancy Services as core vendors with the aggregate minimum contractual obligation remaining of $902.4 million going into 2022.

Of that sum, the minimum contractual obligation to Google was $520 million. In 2021, Google was paid $62 million. IBM was paid $51 million.

2022: Equifax's vendor lineup changed in 2022. Including Google Cloud, AWS, UST Global, Kyndryl (formerly a part of IBM) and others, Equifax's future minimum contractual obligation at the start of 2023 was $948 million. Google and AWS accounted for the majority of that sum.

In its 2022 annual report, Equifax disclosed that its future minimum contractual obligation to Google Cloud was $440 million with no individual year's minimum to exceed about $120 million. In 2022, Equifax paid Google $152 million, up from $62 million in 2021.

For the first time in a regulatory report, Equifax outlined its obligations to AWS for hosting mission critical applications. Equifax's future minimum contractual obligation to AWS was $222 million with no minimum to exceed about $52 million. Equifax paid AWS $74 million in 2022 and added that it paid AWS $58 million in 2021 and $43 million in 2020.

2023: Equifax cited agreements with Google, AWS, UST Global and Kyndryl with an aggregate minimum contractual obligation of $1.4 billion as of Dec. 31, 2023. The minimum contractual obligation to Google for the remaining term was $1 billion with no individual year to exceed $228 million. Google was paid $171 million in 2023, up from $152 million in 2022. AWS' future minimum contractual obligation was $173 million for the remaining term with no individual year exceeding $52 million. AWS was paid $52 million in 2023, down from $74 million in 2022.

Focusing on Equifax AI

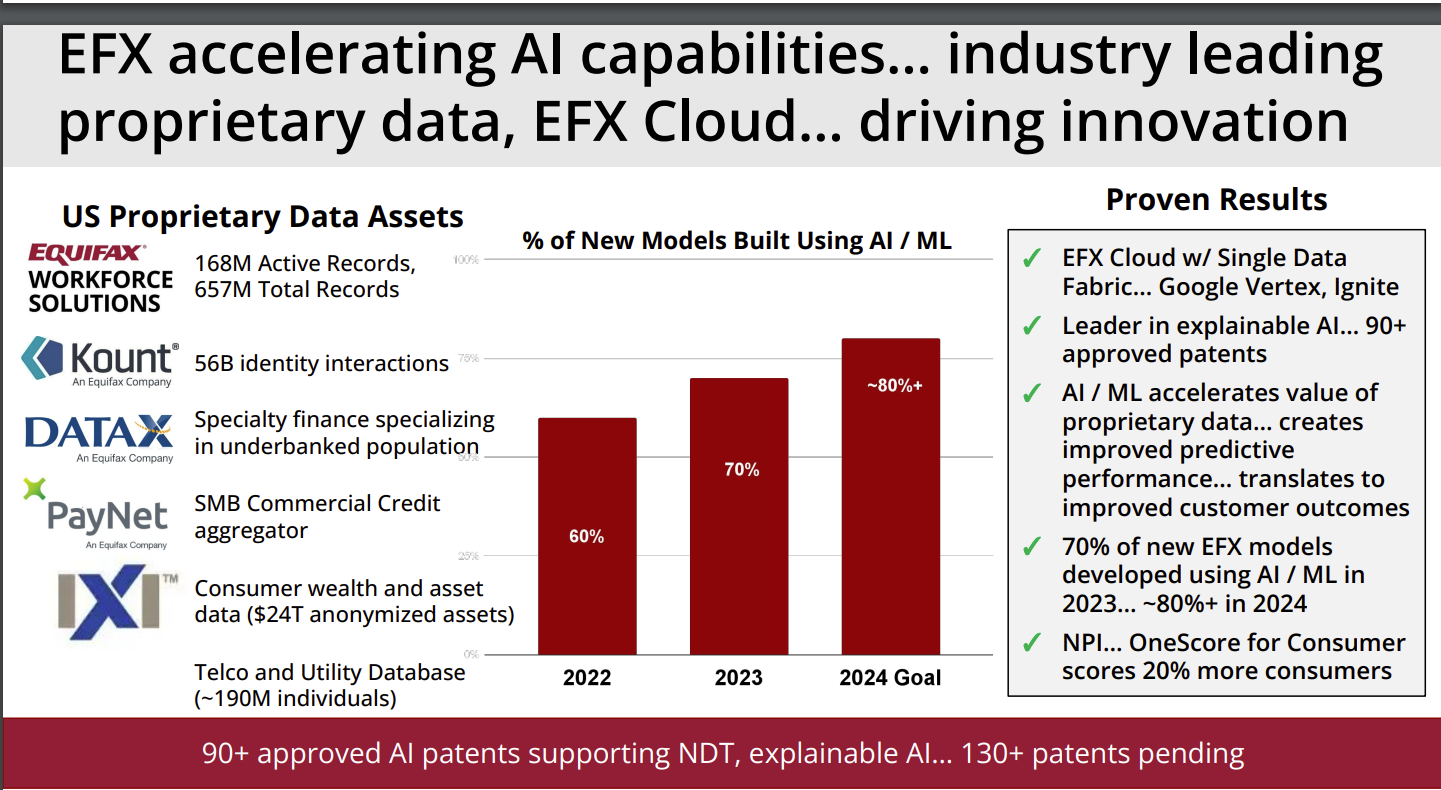

With Equifax's cloud transformation mostly complete, Begor said the company is focusing on Equifax (EFX) AI, which leverages the company's internal data, proprietary data sets and models from its Ignite platform as well as Google Cloud Vertex AI.

"Our proprietary data at scale and our single data fabric leveraging our new EFX Cloud gives us significant advantages in using AI to build more predictive multi-data models, scores and products," said Begor. "Our EFX AI is enabled by our explainable AI solutions that leverage our Ignite platform and our Google Vertex capabilities."

Begor added:

"Our investments in AI are generating results. To date, Equifax has received over 90 approved AI patents supporting areas such as our proprietary AI NeuroDecision Technology, or NDT, an explainable AI with over 130 AI patents pending. We've launched new products developing at EFX AI, including Equifax OneScore for consumers incorporating traditional credit, alternative credit, as well as cell phone utility and pay TV data, which has improved the performance of the solution to score 20% more consumers."

The game plan is to connect more data sets with Equifax AI to create new combinations of data, products and services.

Leveraging Google Cloud's Vertex AI was also an easy leap since Equifax built its data architecture on Google Cloud too. Equifax's data fabric has grown over time, but it's an internal data warehouse with additional capabilities.

Limaye said:

"You have a variety of layers--governance, observability streaming, virtualization, catalog and other things. We built our data platform on top of Google Cloud technology, and we standardized the pipelines at every step. When the data comes, it goes through the initial cleaning and transformation. It also gets entity resolution and linking. There is no differentiation between the operation and the warehouse. Because on the one hand you are getting all this data, you're cleaning it up, and you're making it available for the product. We built our own data hub where we collect data for every platform, and it brings the operational data for different types of uses. We call it purpose views. You could use it for online transactions. There's also typical data warehousing using Google technologies where you can do analytics and marketing on top of Google Cloud."

With cloud savings and new AI-driven products for growth, Equifax is projecting 2024 revenue of $5.72 billion, up 8.6% from 2023. The company expects that its margins will expand due to organic growth and cost savings from its cloud migration. "As we look beyond 2024, the cost benefits of completing our cloud migration as well as accelerating high variable profit revenue growth are expected to drive significant improvement in EBITDA margins," said CFO Gamble.

DOWNLOAD FULL CUSTOMER STORY HERE