Dell Technologies ups AI server shipment outlook amid strong Q3

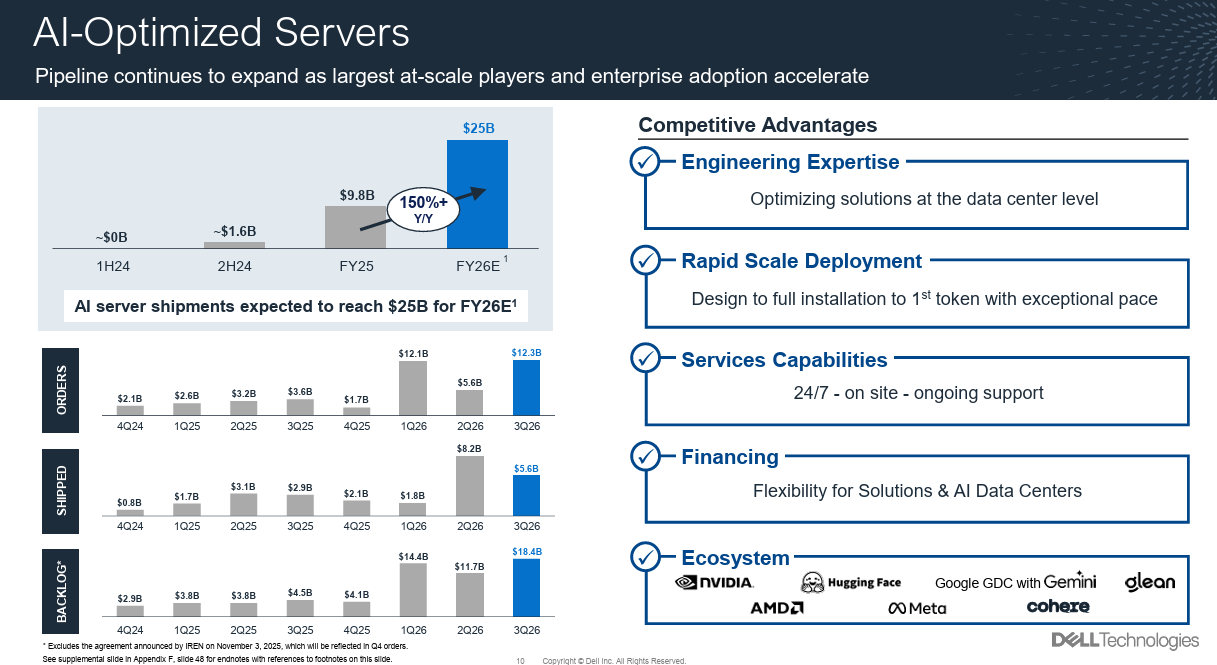

Dell Technologies saw record AI server orders in the third quarter and raised its fiscal 2026 AI shipment guidance to $25 billion, up 150% from a year ago.

The company reported third quarter earnings of $2.28 a share on revenue of $27 billion, up 11% from a year ago. Non-GAAP earnings in the third quarter were $2.59 a share. Wall Street was expecting Dell to report non-GAAP earnings of $2.48 a share on revenue of $27.3 billion.

Dell also named David Kennedy as CFO on a permanent basis. He was interim CFO. Kennedy said fiscal 2026 revenue will be $111.7 billion for the year.

Jeff Clarke, chief operating officer of Dell, said the company has landed $30 billion in AI server orders year to date. "Our five-quarter pipeline is multiples of our $18.4 billion backlog with a mix of neocloud, sovereign and enterprise customers," said Clarke, who noted that Dell is building high-performance systems as well as complex clusters.

Like recent quarters, Dell's growth was powered by its infrastructure solutions group. The client solutions group has struggled to deliver revenue growth.

For the infrastructure unit, Dell reported third quarter revenue of $14.1 billion, up 24% from a year ago. Operating income was $1.7 billion, up 16% from a year ago. Servers and networking revenue was $10.2 billion, up 37% from a year ago, and storage revenue fell 1% to $4 billion.

For the PC unit, Dell reported operating income of $748 million in the third quarter on revenue of $12.5 billion, up 3% from a year ago. Commercial client revenue was up 5% and consumer revenue fell 7%.

As for the outlook, Dell projected the following:

- Fourth quarter revenue will be between $31 billion and $3 billion, up 32% from a year ago. Fourth quarter non-GAAP earnings will be $3.50 a share.

- Fiscal 2026 AI server shipments will be about $25 billion, up 150%.

- Fiscal 2026 non-GAAP earnings will be $9.92 a share on revenue of $111.2 billion and $111.2 billion, up 17%.

On the earnings call, Clarke said:

- Dell has AI racks operational within 24 to 36 hours of delivery with uptime topping 99%.

- The company shipped $5.6 billion in AI servers in the quarter.

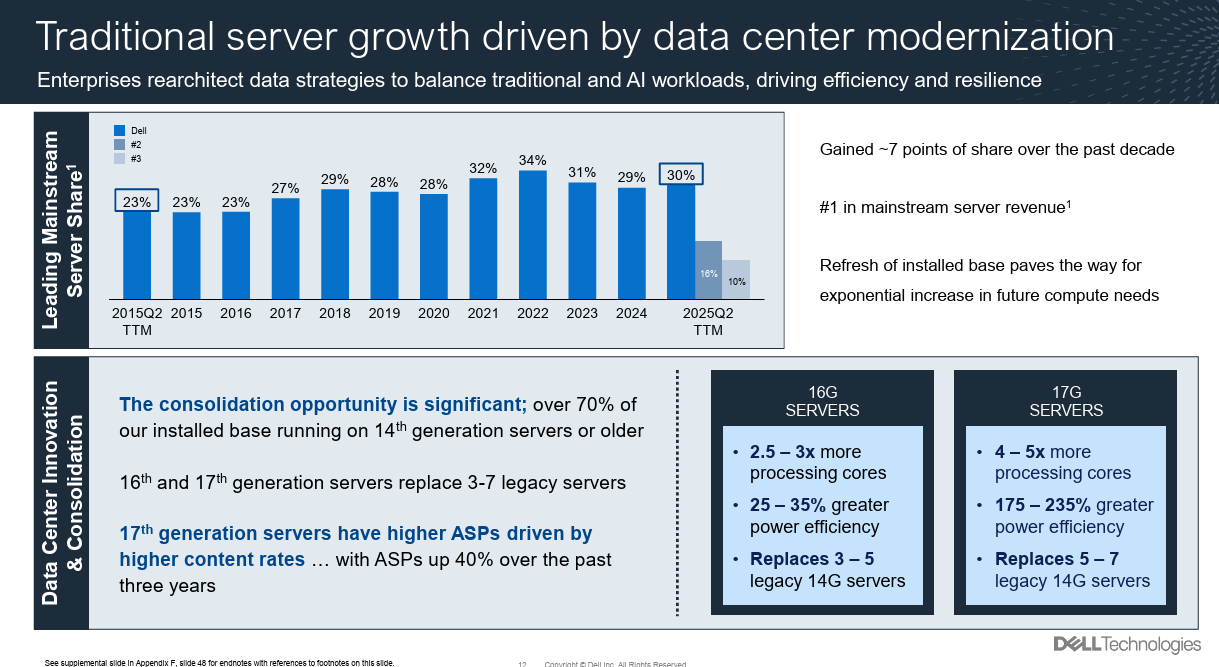

- Traditional server demand grew double-digits in EMEA and North America growth accelerating.

- All-flash array storage systems had double digit demand growth.

- On the supply chain Clarke said: "We are well positioned across our commodity basket - Q3 was deflationary, and our outlook for Q4 is largely unchanged from last quarter. Looking ahead to next year, there will be dynamics that we will have to navigate, but we are confident in our ability to secure supply and adjust pricing as needed."

Kennedy also touched on the fiscal 2027 outlook. He said: "We have strong conviction in our AI business, supported by what we see in our backlog, the pipeline, and ongoing customer discussions. We’ve proven we can execute and deliver for our customers in this space."