The Internet of Things, IoT, has suffered from relentless hype as an emerging technology; inevitably the unjustifiable numbers would not arrive in time to match mass-market perceptions. The foreseeable result is speculation on whether IoT is now failing to deliver on its promise. But is using ‘The Hype Cycle’ really the best way to analyze the performance of a Technology? And, is there an alternative to help Business adopters assess product adoption and risks?

The Hyping of an emerging technology under a single heading; i.e. The Internet, or in this case IoT, fails to separate individual markets and products. Instead a vast range of speculative, innovations, and immature aspects and offerings are all considered together. Natural market selection will ensure that only a small proportion will be commercially successful in the short term. Therefore, the failure of the majority to gain market adoption will lead to the whole Technology category being labeled as entering the ‘Trough of Disillusionment’.

Not for nothing is the form of market monitoring known as the Hype Cycle! Wikipedia offers a good explanation of the workings and methods of ‘The Hype Cycle’, which does have particular values as a technique for assessing Technology. Used as a tool to compare the progression along a time line of one technology against another it provides a simple straightforward approach. A good current example is the comparison of the relative maturity of Big Data, AI, and IoT measured against each other.

The Hype Cycle Mass Technology time line doesn’t serve to analysis specifics in terms of products and Business uptake in selected and focused areas. Though the definition for the part of the Hype Cycle that relates to successful business adoption, termed ‘Slope of Enlightenment’ is excellent, the reality is that detailed analysis is difficult;

‘The Slope of Entitlement’; More instances of how the technology can benefit the enterprise start to crystallize and become more widely understood. Second- and third-generation products appear from technology providers. More enterprises fund pilots; conservative companies remain cautious. Source Wikipedia; The Hype Cycle

Selective elements and products start to stand out from the overall mass of the market, because the choice to deploy has become related to an understood Business value, rather than a Technology based experimentation.

So are there signs that some aspects of IoT technology, and products, have reached the tipping point around; 1) Business adoption for specific purposes is now recognized as a self evident Business activity; and 2) Are there alternative ways to verify the commercial maturity and risk of techniques and products for Business use?

In answer to 1) this blog series has been charting the IoT Hype Cycle over the last two years and, with hindsight, there started to be discernable signs of reaching a new stage in the IoT market from the Spring of 2016. As evidence the following four blogs can be seen as key signs of the increasing Business involvement in the Internet of Things, IoT. This includes the introduction of the second-generation products that enhance the business value, which in the case of IoT has been a new emphasis towards the Analytics of Things, AoT. In a classic maturity shift Business Management relates to the business value in the Data of AoT, but is ambivalent about needing to get involved in IoT and the Technology of Sensors!

Why Honeywell's Reported Desire to Sell Its Building Solutions Business Says a Lot About IoT; The Building Management Services market has become an early target market for IoT business led deployments, resulting in established players facing a disruptive market under going transformation.

IoT; Where are the Integrators? Perhaps more importantly who are the Integrators!; Faced with the emergence of not just online Digital markets, but with interactive real-time event optimized ‘Smart Services’, enterprises have turned to Management Consultants to ‘integrate’ their business models and not to Technology Integrators.

From the Internet of Things, to the Analytics of Things focusing on new forms of Analytics coupled to Smart Services; As first mover business case studies become available the crucial success factor has been seen to shift from the application of ‘sensors’ towards the value from analytics of data flows to empower competitive Smart Services.

Real Time IoT Sensing requires Real Time Responsive Apps, and only now are these arriving in the market; The three factors above have combined to see new second generation products from both established, and start up, Technology vendors that directly support the newly recognized business requirements.

Taken together with an increasing number of published case studies, more usually in the Business Management Press than the Technology Press, the conditions defined by The Hype Cycle for some aspects of the IoT market to be moving onto the Slope of Enlightenment are being met.

IoT is successful when it meets the value requirements defined by Business Adoption, not by Technology capabilities. The challenge for the Business Adopters is how to analysis the maturity of Products which are not just ‘new’, but often from startup companies. Disruptive Technology driven business market disruption is not new, in fact over the period since 1990 it has occurred to varying degrees multiple times. Consider the impacts of the PC, Networks, The Web, Social Networks and The Cloud.

Today the level and type of market disruption that is occurring has moved to directly introduce Business involvement, who need assistance in evaluation of Business maturity of techniques and products.

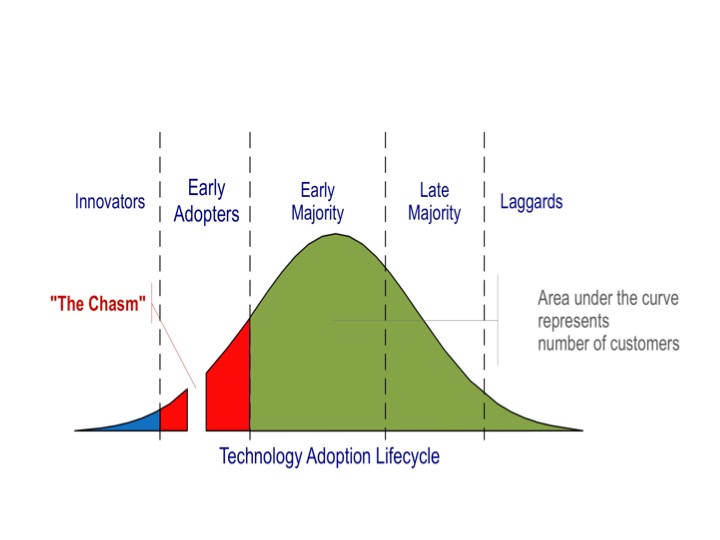

Geoffrey Moore introduced the concept of tracking the Business uptake of High Tech Products in his book ‘Crossing the Chasm’ using the adoption curve illustrated below. (If you are involved in any way with innovative technology then this is a ‘must read’ book). Though intended as a business management book for the successful launch and execution of introducing disruptive technology products the insights are just as invaluable for those requiring to analysis commercial success curves of a product before purchase.

The first publication in 1991 of this book to introduce the ‘crossing the chasm’ concept followed the first major business disruption caused by technology; the arrival of PCs and Networked Applications. Since then ‘Crossing the Chasm’ has been successfully applied to understand each of the successive waves with revisions to details to ensure its current value is preserved. Oddly, and perhaps due to its Business focus on details, Crossing the Chasm seems to receive much less publicity than the Hype Cycle. Certainly The Hype Curve makes for much better headlines!

Diagram curtsey of Wikipedia Commons

‘Crossing the Chasm’ refers to the moment when true business value becomes apparent and the technology/product switches to becoming purchased for its recognized commercial value rather than its perceived technology possibilities. Though still an early adopter market the shift is a profound moment when early adopters move from deploying in the hope of a business advantage to buying to deliver a recognized business advantage.

Product release cycles of Major technology vendors are focused on pushing a new product ‘across the chasm’ to gain commercial success; Innovate with beta release; build references and case studies with first wave early adopters for go to market material; then launch to the mass market around the business value delivered. The product market launch is literally the moment when the vendor tries to make sure that their product crosses the chasm into commercial market uptake.

As buyers of products there is recognition that there has been a process to ensure the released product is mature enough to be safe for deployment. Availability doesn’t mean the timing is right for all enterprises, many will wait to see the experiences of the first wave of post chasm early adopters. Their decision to be in the early majority is less about technology risk to early competitive benefit, and more about the rate that there enterprise adopts competitive positions in their particular market. For the late majority, adoption is more likely to be forced upon their enterprise by the shift in competitive positioning that the early majority has forced upon them.

Its possible to use the Crossing the Chasm approach not only for its original purpose of defining go to market phases for a product or a startup vendor, but to define/align your Enterprise timing to adopting a particular technology shift. The rate at which the innovative technology disruption is turning into understandable Business value, and then to sector, or activity transformation can be measured by tracking product adoption across the stages.

As an example; if your industry is Building Management then use Internet searches to find products and case studies to establish your curve from the published material. Position the findings along the curve by the type of results; early adopter technology driven, case study on business value, or business management to sector transformation. Soon certain vendors and their products will start to become prominent illustrating the products that are driving the market. (A word of warning, that may just be because they have good marketing and large budgets so do verify the content used)

An industry sector, or activity, curve of adoption based on real product uptake tells a great deal about the timing and will allow factual analysis for your enterprise of the change rate. It also provides a short list of products for more detailed examination, each of which has an individual product adoption curve for its market penetration and customer adoption maturity. Even if the product comes from a relatively unknown startup this approach shows real success achieved.

If your enterprise plans to gain early adopter advantage either before, or after, the chasm, certainly before the market and products become early/late majority with various product feature comparison formats, then this is an approach to seriously consider.

To return to the opening question; is IoT in the Trough of Disillusionment? Yes; certainly if your goal is to track the overall market and the inevitable first wave shake out. Are there specific sector or activity hot spots with leading products? Then the answer is also yes, and more importantly it’s a yes based on using a more suitable approach for focused analyzing around real business adoption.